You are given the following information about 50-strike and 60-strike European put options with the same stock

Question:

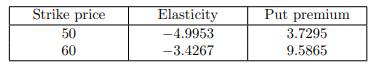

You are given the following information about 50-strike and 60-strike European put options with the same stock and time to expiration:

Calculate the elasticity of a 50-60 European put bull spread.

Transcribed Image Text:

Strike price 50 60 Elasticity -4.9953 -3.4267 Put premium 3.7295 9.5865

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (3 reviews)

The 5060 put bull spread is set up by buying the 50strike put ...View the full answer

Answered By

Rinki Devi

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions.

Hi there! Are you looking for a committed, reliable, and enthusiastic tutor? Well, teaching and learning are more of a second nature to me, having been raised by parents who are both teachers. I have done plenty of studying and lots of learning on many exciting and challenging topics. All these experiences have influenced my decision to take on the teaching role in various capacities. As a tutor, I am looking forward to getting to understand your needs and helping you achieve your academic goals. I'm highly flexible and contactable. I am available to work on short notice since I only prefer to work with very small and select groups of students.

I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and helped them achieve great subject knowledge.

5.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

What does the Black-Sholes-Merton stock option pricing model assume about the probability distribution of the stock price in one year? What does it assume about the continuously compounded rate of...

-

You think the price of AMZN stock, which is currently $900 is likely to change significantly over the next three months, you are just not sure which direction. So you buy a long straddle position,...

-

You are given the following information about two options, A and B: (i) Option A is a one-year European put with exercise price 45. (ii) Option B is a one-year American call with exercise price 55....

-

Classify each of the following items as a public good, a private good, a mixed good, or a common resource. Georges Banks cod stock A courtside seat at the U.S. Open (tennis) A well-stocked buffet...

-

On February 17, 2007 a flood destroyed the work in process inventory and half the raw materials inventory of the LRT Company. There was no damage to the finished goods inventory. A physical inventory...

-

Here is a simplified balance sheet for Epicure Pizza (figures in $ millions): Epicure shares are currently priced at $12 each. a. You wish to calculate Epicure?s WACC. What is the relevant figure for...

-

1. Taskwork processes are the activities of team members that relate directly to the accomplishment of team tasks. Taskwork processes include creative behavior, decision making, and boundary spanning.

-

Linebarger Corporation has net income of $11.44 million and net revenue of $95 million in 2014. Its assets are $14 million at the beginning of the year and $18 million at the end of the year. What...

-

Why is the rate that debt holders require to entice them to lend money to a company different from the companys effective cost of debt capital

-

Assume the Black-Scholes framework. Consider a 3-month European contingent claim on a stock. You are given: (i) The stock is currently selling for 50. (ii) The stock will pay a single dividend of 1.5...

-

Assume the Black-Scholes framework. For a 3-month at-the-money European put option on a stock, you are given: (i) The stock is currently selling for 50. (ii) The stock will pay a single dividend of...

-

What are the elements of Dells strategy? Which one of the five generic competitive strategies is Dell employing? How well do the pieces of Dells strategy fit together? Is the strategy evolving and,...

-

5.3 BEP Example Bill Braddock is considering opening a Fast 'n Clean Car Service Center. He estimates that the following costs will be incurred during his first year of operations: Rent $9,200,...

-

The following is the text for an opinion on internal control for W Company, an issuer. Some words or phrases have been replaced with numbers (e.g., [1], [2], etc.). Select from the option list...

-

Problem 14-23 (Static) Comprehensive Problem [LO14-1, LO14-2, LO14-3, LO14-5, LO14-6] Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new...

-

The farm business owes income taxes at the end of the year because income taxes are not paid until after the end of the year is true or false

-

So there were some changes in "Kieso intermediate accounting 15th edition"chapter 18 (revenue recognition). Is the test bank the same as before? If not when and what year did the update occur? Please...

-

In each case, show that T6 = 1R4 and so determine T-l. (a) T: R4 R4; T(x, y, z, w) = (-y, x - y, z, -w)

-

The words without recourse on an indorsement means the indorser is: a. not liable for any problems associated with the instrument. b. not liable if the instrument is dishonored. c. liable personally...

-

The following beginning-of-month (BOM) and end of month (EOM) amounts are to be deposited in a savings account that pays interest at 9% compounded monthly: Today (BOM 1) $400 EOM2 270 EOM6 100 EOM7...

-

Net revenues at an older manufacturing plant will be $2 million for this year. The net revenue will decrease 15% per year for 5 years, when the assembly plant will be closed (at the end of Year 6)....

-

What is the present worth of cash flows that begin at $10,000 and increase at 8% per year for 4 years? The interest rate is 6%

-

Yield to Maturity and Call with Semiannual Payments Shares Remaining After Recapitalization Dye Trucking raised $75 million in new debt and used this to buy back stock. After the recap, Dye's stock...

-

What is the yield to maturity on a 10-year, 9% annual coupon, $1,000 par value bond that sells for $967.00? That sells for $1,206.10?

-

1)Prepare the journal entry to record Tamas Companys issuance of 6,500 shares of $100 par value, 9% cumulative preferred stock for $105 cash per share. 2. Assuming the facts in part 1, if Tamas...

Study smarter with the SolutionInn App