In the US, interest rates in the money market are quoted using an Actual/360 convention. The word

Question:

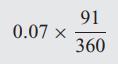

In the US, interest rates in the money market are quoted using an “Actual/360” convention. The word “Actual” refers to the actual number of days in the investment period. For example, if the interest rate for a three-month period is given to be 7% and the actual number of calendar days in the three-month period is 91, then the actual interest received on a principal of $1 is

Many other countries too (including the Euro zone) use the Actual/360 convention, but the British money-market convention uses Actual/365. This question and the next four pertain to calculating forward prices given interest rates in the money-market convention. Suppose the 90-day interest rate in the US is 3%, the 90-day interest rate in the UK is 5% (both quoted using the respective money-market conventions), and the spot exchange rate is £1 = $1.75.

(a) What is the present value of $1 receivable in 90 days?

(b) What is the present value of £1 receivable in 90 days?

(c) What is the 90-day forward price of £1?

Step by Step Answer: