The following asset-pricing factor returns are downloaded from the FamaFrench database: the excess market return, the SMB

Question:

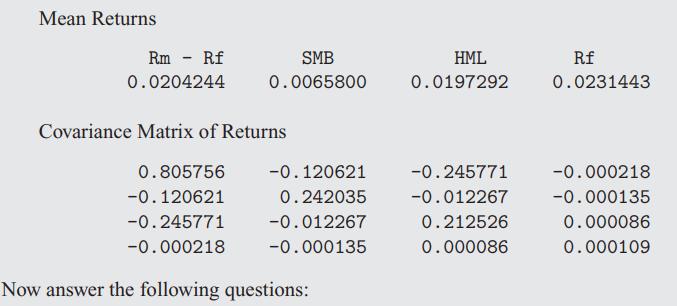

The following asset-pricing factor returns are downloaded from the FamaFrench database: the excess market return, the SMB portfolio return, the HML portfolio return, and the risk-free return. From the downloaded data, which is for the period 1963–2003, we get the following mean and covariance matrix:

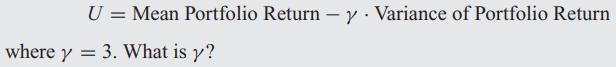

(a) Given the following utility function, compute the optimal portfolio weights:

(b) For the given portfolio weights, compute the 99% VaR of the optimal portfolio.

(c) Compute the risk decomposition of the portfolio, and allocate the risk across the four asset classes. Which asset class contributes the most risk?

(d) Now choose some random weights different from the optimal ones you just computed. Recompute the VaR. Is the risk measure higher or lower? Why?

(e) If you had to double the proportions of just one of the assets, which one would you choose? Why?

Step by Step Answer: