(a) Plot the 2, 3, 4, 5, 6 and 9 months United States zero coupon yields using...

Question:

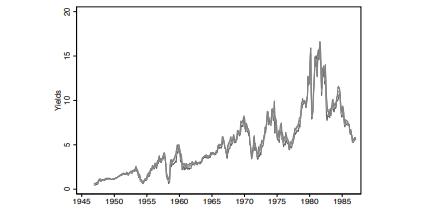

(a) Plot the 2, 3, 4, 5, 6 and 9 months United States zero coupon yields using a line chart and compare the result in Figure 2.6.

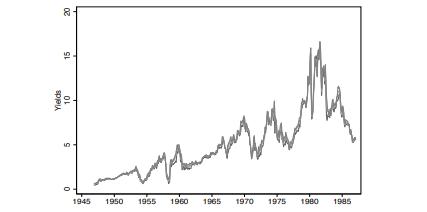

(b) Compute the spreads on the 3-month, 5-month and 9-month zero coupon yields relative to the 2-month yield and and plot these spreads using a line chart. Compare the graph with Figure 2.6.

(c) Compare the graphs in parts (a) and (b) and discuss the time series properties of yields and spreads.

Step by Step Answer:

Related Book For

Financial Econometric Modeling

ISBN: 9781633844605

1st Edition

Authors: Stan Hurn, Vance L. Martin, Jun Yu, Peter C.B. Phillips

Question Posted: