In 2003, ten states increased the taxes they placed on cigarettes. Because taxes increase the price of

Question:

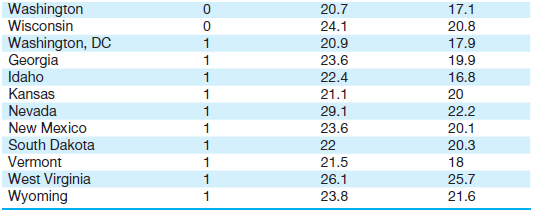

In 2003, ten states increased the taxes they placed on cigarettes. Because taxes increase the price of cigarettes, we’d expect that a tax increase would reduce the consumption of cigarettes. In Table 16.2, we present cross-sections of state level data on cigarette consumption for the years 2000 and 2006. Forty-four states plus the District of Columbia are listed here, with those states that did not have a tax increase in 2003 listed first.

a. Would you consider this to be a random assignment experiment data set, a natural experiment data set, or a panel data set? Explain.

b. Depending on your answer to part a, use the appropriate estimation technique to determine the impact of the cigarette tax increase on the consumption of cigarettes.

c. Do these results conform with your expectations? If they don’t, what problems do you see with this research design?

Table 16.2 Cigarette Consumption by State

Step by Step Answer: