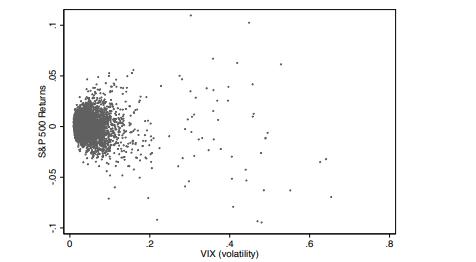

The data are daily returns to the S&P 500 Index and a proxy for the conditional variance

Question:

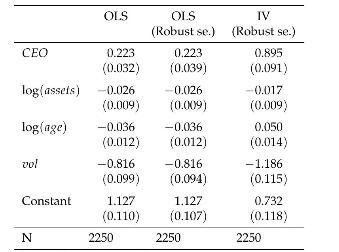

The data are daily returns to the S&P 500 Index and a proxy for the conditional variance based on the VIX Index for the period 2 January 1990 Ordinary least squares and instrumental variables regressions of the logarithm of Tobin's \(Q, \log \left(Q_{i}\right)\), on the explanatory variables shown. The potentially endogenous variable CEO is instrumented with the mean age of the founder in 1994, ageF, in the instrumental variables regression.

to 1 June \(2012(T=5652)\). A simple statement of the intertemporal CAPM is \[ r_{t}=\alpha+\gamma \mathrm{E}_{t-1}\left(\sigma_{t}^{2}\right)+u_{t} \]

in which \(\alpha=0\) and \(\gamma>0\) is hypothesised. Using an observable proxy, \(h_{t}\), for \(\mathrm{E}_{t-1}\left(\sigma_{t}^{2}\right)\) yields \[ \begin{aligned} r_{t} & =\alpha+\gamma h_{t}-\gamma \epsilon_{t}+u_{t} \\ & =\alpha+\gamma h_{t}+v_{t} \end{aligned} \]

in which \(v_{t}=-\gamma \epsilon_{t}+u_{t}\) is now a composite error term.

(a) Draw a scatter plot of the relationship between daily returns to the S\&P 500 Index and the proxy for the conditional variance and thus reproduce Figure 8.1.

Figure 8.1.

(b) Estimate the risk aversion parameter \(\gamma\) by ordinary least squares. Discuss the properties of the estimator.

(c) Now estimate \(\gamma\) by instrumental variables using instrumental variables using \(h_{t-1}\) as and instrument for \(h_{t}\). Discuss the results.

(d) Test for the endogeneity of \(h_{t}\) in the original regression specification using the auxiliary regression approach. What do you conclude?

(e) Compute the instrumental variables estimator of \(\gamma\) in two stages by first constructing \(\widehat{h}_{t}\) from a reduced from regression on its instrument and then substituting these fitted values into the structural equation. Compare the standard errors you obtain with those from part (c). Correct the standard error on \(\gamma\) obtained from the two stage procedure and hence reproduce the value obtained in (c).

Step by Step Answer:

Financial Econometric Modeling

ISBN: 9781633844605

1st Edition

Authors: Stan Hurn, Vance L. Martin, Jun Yu, Peter C.B. Phillips