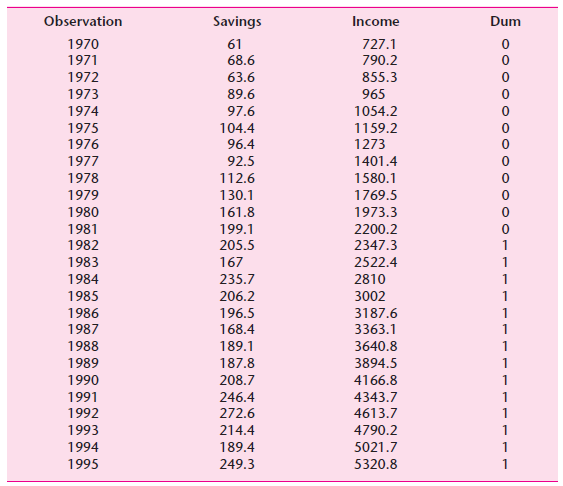

Use the data given in the following table and consider the following model: ln Savings i =

Question:

ln Savingsi = β1 + β2 ln Incomei + β3 ln Di + ui

where ln stands for natural log and where Di = 1 for 1970€“1981 and 10 for 1982€“1995.

a. What is the rationale behind assigning dummy values as suggested?

b. Estimate the preceding model and interpret your results.

c. What are the intercept values of the savings function in the two subperiods and how do you interpret them?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: