A division of ConocoPhillips is involved in their periodic capital budgeting activity, and the engineering and operations

Question:

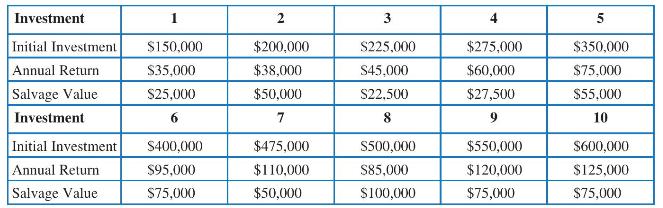

A division of ConocoPhillips is involved in their periodic capital budgeting activity, and the engineering and operations staffs have identified 10 indivisible investments with cash flow parameters shown below. ConocoPhillips uses a 10-year planning horizon and a MARR of 10 percent in evaluating such investments. The division's capital limit for this budgeting cycle is \(\$ 2,500,000\).

For the original problem statement:

a. Which alternatives should ConocoPhillips select?

b. What is the present worth of the optimum portfolio?

c. What is the IRR for the portfolio?

In addition to the original problem statement, ConocoPhillips has noted that Investments 1 and 3 are mutually exclusive, Investment 4 is contingent on either Investment 2 or Investment 5 being funded, and at least five investments must be made.

d. Which alternatives should now be selected?

e. What is the present worth for the new portfolio?

f. What is the IRR for the investment portfolio?

Consider the original problem using SOLVER for sensitivity analysis:

g. Determine the optimum portfolio (state the investments selected and the portfolio PW) using (1) the current limit on investment capital, (2) plus 20 percent, and (3) minus 20 percent.

h. Determine the optimum portfolio (state the investments selected and the portfolio PW) using (1) the current MARR, (2) plus 20 percent, and (3) minus 20 percent.

Step by Step Answer:

Principles Of Engineering Economic Analysis

ISBN: 9781118163832

6th Edition

Authors: John A. White, Kenneth E. Case, David B. Pratt