A large company has the opportunity to select one of seven projects-A, B, C, D, E, F,

Question:

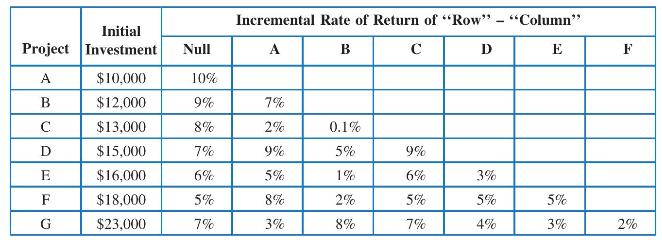

A large company has the opportunity to select one of seven projects-A, B, C, D, E, F, G-or choose the null (donothing) alternative. Each project requires a single initial investment as shown in the table below. Information on each alternative was fed into a computer program that calculated the IRR for each project and all the pertinent incremental IRRs as shown in the table below.

For example, the IRR for Project A is 10 percent and the incremental IRR of Project C minus Project B (C - B) is 0.1 percent. For each value of MARR below, indicate which project is preferred and the evaluations you made to arrive at this conclusion.

a. \(M A R R=12\) percent

b. \(M A R R=9.5\) percent

c. \(M A R R=8\) percent

d. \(M A R R=3.5\) percent

e. \(M A R R=1.5\) percent

Step by Step Answer:

Principles Of Engineering Economic Analysis

ISBN: 9781118163832

6th Edition

Authors: John A. White, Kenneth E. Case, David B. Pratt