Alternatives 1, 2, and 3 have lives of 3, 4, and 6 years, respectively. Their net cash

Question:

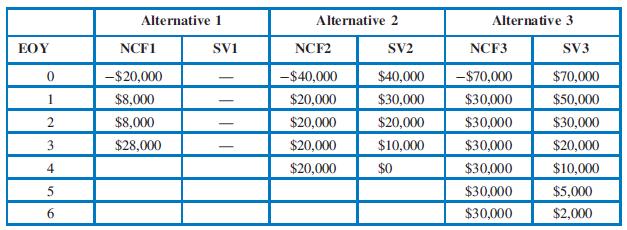

Alternatives 1, 2, and 3 have lives of 3, 4, and 6 years, respectively. Their net cash flow (NCF) and salvage value (SV) profiles are as follows:

Additional explanation is necessary: The NCF profile of Alternative 1 that is shown above is the net result of a \($20,000/year\) lease payment payable at the beginning of each year, plus an end of year net revenue of \($28,000.\) This lease arrangement may be renewed in 3-year increments; however, premature cancellation of the lease results in a lease termination penalty (cost) of \($10,000\) at the time of cancellation. MARR is 8 percent.

a. What is the planning horizon for these alternatives if a least common multiple approach is used to determine the planning horizon?

b. Assume the NCFs of all alternatives are expected to repeat indefinitely as shown. If a least common multiple of lives approach is to be used, specify the complete set of cash flows for each alternative and the annual worth for each alternative.

c. Repeat Part b by determining the annual worth of each alternative based on its ‘‘natural’’ life (i.e., 3 years for Alt. 1, 4 years for Alt. 2, and 6 years for Alt. 3).

d. Compare your answers for Parts b and c. Explain how your results either confirm or dispute the claim that the AW measure of merit implicitly assumes a least common multiple planning horizon.

Step by Step Answer:

Principles Of Engineering Economic Analysis

ISBN: 9781118163832

6th Edition

Authors: John A. White, Kenneth E. Case, David B. Pratt