Based on Exhibit A, the forward premium or discount for a 360-day INR/GBP forward contract is closest

Question:

Based on Exhibit A, the forward premium or discount for a 360-day INR/GBP forward contract is closest to:

A. -1.546 .

B. 1.546 .

C. 1.576 .

Transcribed Image Text:

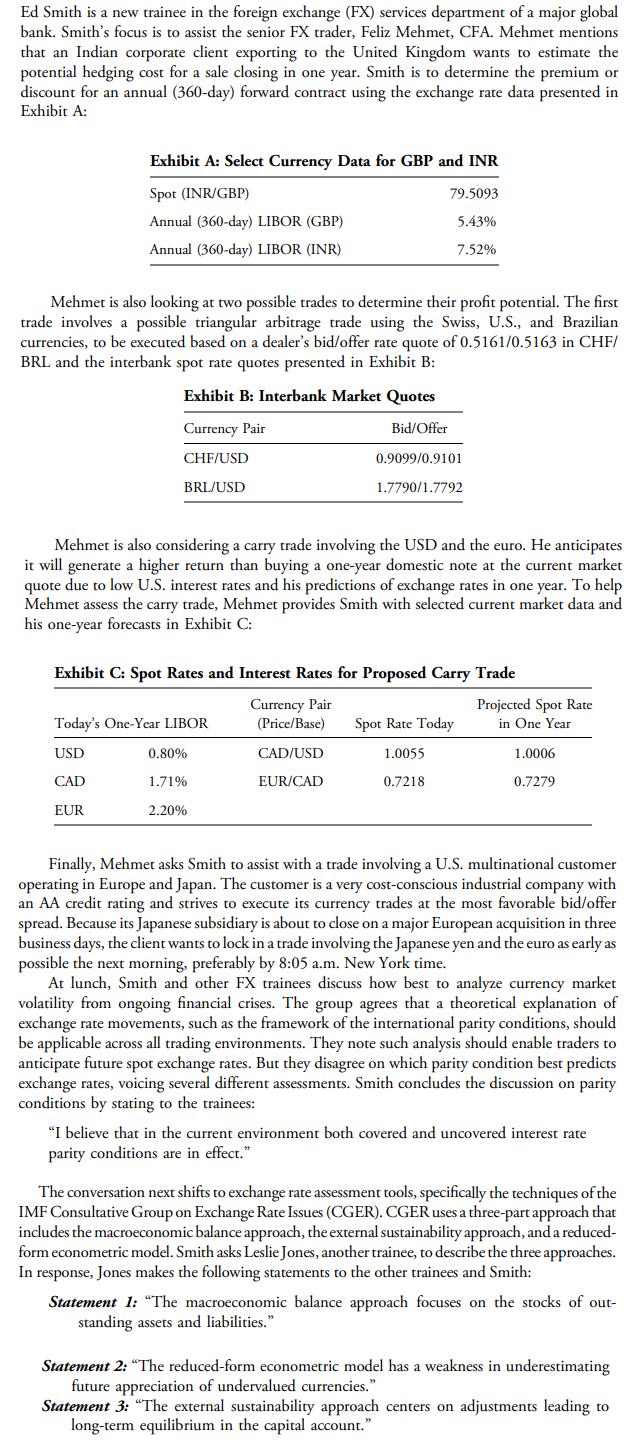

Ed Smith is a new trainee in the foreign exchange (FX) services department of a major global bank. Smith's focus is to assist the senior FX trader, Feliz Mehmet, CFA. Mehmet mentions that an Indian corporate client exporting to the United Kingdom wants to estimate the potential hedging cost for a sale closing in one year. Smith is to determine the premium or discount for an annual (360-day) forward contract using the exchange rate data presented in Exhibit A: Exhibit A: Select Currency Data for GBP and INR Spot (INR/GBP) Annual (360-day) LIBOR (GBP) Annual (360-day) LIBOR (INR) 79.5093 5.43% 7.52% Mehmet is also looking at two possible trades to determine their profit potential. The first trade involves a possible triangular arbitrage trade using the Swiss, U.S., and Brazilian currencies, to be executed based on a dealer's bid/offer rate quote of 0.5161/0.5163 in CHF/ BRL and the interbank spot rate quotes presented in Exhibit B: Exhibit B: Interbank Market Quotes Currency Pair CHF/USD BRL/USD Bid/Offer 0.9099/0.9101 1.7790/1.7792 Mehmet is also considering a carry trade involving the USD and the euro. He anticipates it will generate a higher return than buying a one-year domestic note at the current market quote due to low U.S. interest rates and his predictions of exchange rates in one year. To help Mehmet assess the carry trade, Mehmet provides Smith with selected current market data and his one-year forecasts in Exhibit C: Exhibit C: Spot Rates and Interest Rates for Proposed Carry Trade Today's One-Year LIBOR Currency Pair (Price/Base) Projected Spot Rate USD 0.80% CAD/USD Spot Rate Today 1.0055 in One Year 1.0006 CAD 1.71% EUR/CAD 0.7218 0.7279 EUR 2.20% Finally, Mehmet asks Smith to assist with a trade involving a U.S. multinational customer operating in Europe and Japan. The customer is a very cost-conscious industrial company with an AA credit rating and strives to execute its currency trades at the most favorable bid/offer spread. Because its Japanese subsidiary is about to close on a major European acquisition in three business days, the client wants to lock in a trade involving the Japanese yen and the euro as early as possible the next morning, preferably by 8:05 a.m. New York time. At lunch, Smith and other FX trainees discuss how best to analyze currency market volatility from ongoing financial crises. The group agrees that a theoretical explanation of exchange rate movements, such as the framework of the international parity conditions, should be applicable across all trading environments. They note such analysis should enable traders to anticipate future spot exchange rates. But they disagree on which parity condition best predicts exchange rates, voicing several different assessments. Smith concludes the discussion on parity conditions by stating to the trainees: "I believe that in the current environment both covered and uncovered interest rate parity conditions are in effect." The conversation next shifts to exchange rate assessment tools, specifically the techniques of the IMF Consultative Group on Exchange Rate Issues (CGER). CGER uses a three-part approach that includes the macroeconomic balance approach, the external sustainability approach, and a reduced- form econometric model. Smith asks Leslie Jones, another trainee, to describe the three approaches. In response, Jones makes the following statements to the other trainees and Smith: Statement 1: "The macroeconomic balance approach focuses on the stocks of out- standing assets and liabilities." Statement 2: "The reduced-form econometric model has a weakness in underestimating future appreciation of undervalued currencies." Statement 3: "The external sustainability approach centers on adjustments leading to long-term equilibrium in the capital account."

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Answered By

Rashul Chutani

I have been associated with the area of Computer Science for long. At my university, I have taught students various Computer Science Courses like Data Structures, Algorithms, Theory of Computation, Digital Logic, System Design, and Machine Learning. I also write answers to questions posted by students in the area of and around Computer Science.

I am highly fortunate to receive great feedback on my teaching skills that keeps me motivated. Once a student sent me an email stating that I had explained to him a concept better than his professor did.

I believe in the fact that "Teaching is the best way to learn". I am highly fascinated by the way technology nowadays is solving real-world problems and try to contribute my bit to the same.

Besides tutoring, I am a researcher at the Indian Institute of Technology. My present works are in the area of Text Summarization and Signal and Systems.

Some of my achievements include clearing JEE Advanced with an All India Rank of 306 out of 1.5 million contesting candidates and being the Department Ranker 1 at my University in the Department of Computer Science and Engineering.

I look forward to providing the best Tutoring Experience I can, to the student I teach.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Economics For Investment Decision Makers

ISBN: 9781118111963

1st Edition

Authors: Sandeep Singh, Christopher D Piros, Jerald E Pinto

Question Posted:

Students also viewed these Business questions

-

Based on Exhibit C, the potential all-in USD return on the carry trade is closest to: A. 1.04 percent. B. 1.40 percent. C. 1.84 percent. Ed Smith is a new trainee in the foreign exchange (FX)...

-

Based on Exhibit B, the most appropriate recommendation regarding the triangular arbitrage trade is to: A. decline the trade, as no arbitrage profits are possible. B. execute the trade; buy BRL in...

-

Which of the following statements given by trainee Jones in describing the approaches used by CGER is most accurate? A. Statement 1 B. Statement 2 C. Statement 3 Ed Smith is a new trainee in the...

-

The balance sheet for the Heir Jordan Corporation follows. Based on this information and the income statement in the previous problem, supply the missing information using the percentage of sales...

-

What is the momentum of a proton traveling at v = 068c?

-

The internal auditors of a large university were assigned to audit the student aid office. Three audit questions were: 1. What are the comparative proportions of funds processed for (a) student loans...

-

Use Tables VIII, IX, X, and XI of Appendix B to find each of the following F values: a. F,, where vl = 9 and v2 = 6 b. Fnl where v, = 18 and v2 = 14 c. F,,,, where v, = 11 and v2 = 4 d. Fln where v,...

-

Morrison and Amato have decided to form a partnership. They have agreed that Morrison is to invest $150,000 and that Amato is to invest $50,000. Morrison is to devote one-half time to the business...

-

Which of the following forms would a lottery winner receive for her winnings? A. Form 1099-DIV B. Form 1099-R C. Form 1099-MISC D. Form W-4 E. Form W-2G

-

The factor least likely to lead to a narrow bid/offer spread for the industrial company's needed currency trade is: A. the timing of its trade. B. the company's credit rating. C. the pair of...

-

A country with a persistent trade surplus is being pressured to let its currency appreciate. Which of the following best describes the adjustment that must occur if currency appreciation is to be...

-

1. Is the decision managers at Aetna made to have a $16 an hour wage floor a programmed or nonprogrammed decision? 2. How did managers recognize the need to make this decision? 3. To what extent do...

-

Jimmy Joe-Bob Hicky is the district commander for the mostly-rural Spud Valley highway patrol district in western Idaho. Hes attempting to assign highway patrol cars to different road segments in his...

-

Its important to have a holistic view of all the businesses combined and ensure that the desired levels of risk management and return generation are being pursued. Agree or disagree

-

(3pts each) During a trip to a casino, Adam Horovitz plays his favorite casino game 10 times. Each time he plays, he has a 41% chance of winning. Assume plays of the game are independent. a. What is...

-

An epidemiologist plans to conduct a survey to estimate the percentage of women who give birth. How many women must be surveyed in order to be 95% confident that the estimated percentage is in error...

-

Statement of financial position as at 31 December 2014 ASSETS Non-current assets Property, plant and equipment Delivery van at cost 12,000 Depreciation (2,500) 9,500 Current assets Inventories...

-

In two or three paragraphs, explain how the WIPO's Domain Name Dispute Resolution process overcomes some of the jurisdictional issues that might arise if a United States court were to hear these...

-

The ultimate goal of Google, Bing, and other consumer search engines is to provide users with search listings that contain useful information on the topic of their search. What recommendations would...

-

Why is there a trade-off between the amount of consumption that people can enjoy today and the amount of consumption that they can enjoy in the future? Why cant people enjoy more of both? How does...

-

How does investment as defined by economists differ from investment as defined by the general public? What would happen to the amount of investment made today if firms expected the future returns to...

-

Catalogue companies are the classic example of perfectly inflexible prices because once they print and ship out their catalogues they are committed to selling at the prices printed in their...

-

There is a credit rating agency for businesses that gives out various amounts of information based on the subscription level. This company is called a. Business Credit Scoring b. Fair Issue c. Dun...

-

Current Attempt in Progress On July 3 1 , 2 0 2 2 , Crane Compary had a cash balance per books of $ 6 , 2 4 5 . 0 0 . The statement from Dakata State Bark on that date showed a balance of $ 7 , 7 9 5...

-

Cede & Co. expects its EBIT to be $89,000 every year forever. The firm can borrow at 5 percent. Cede currently has no debt, and its cost of equity is 10 percent. If the tax rate is 35 percent, what...

Study smarter with the SolutionInn App