Based on Statement 4 and Exhibit C, the sluggish economic growth in Country C is least likely

Question:

Based on Statement 4 and Exhibit C, the sluggish economic growth in Country C is least likely to be explained by:

A. limited labor force growth.

B. export-driven currency appreciation.

C. poorly developed economic institutions.

Transcribed Image Text:

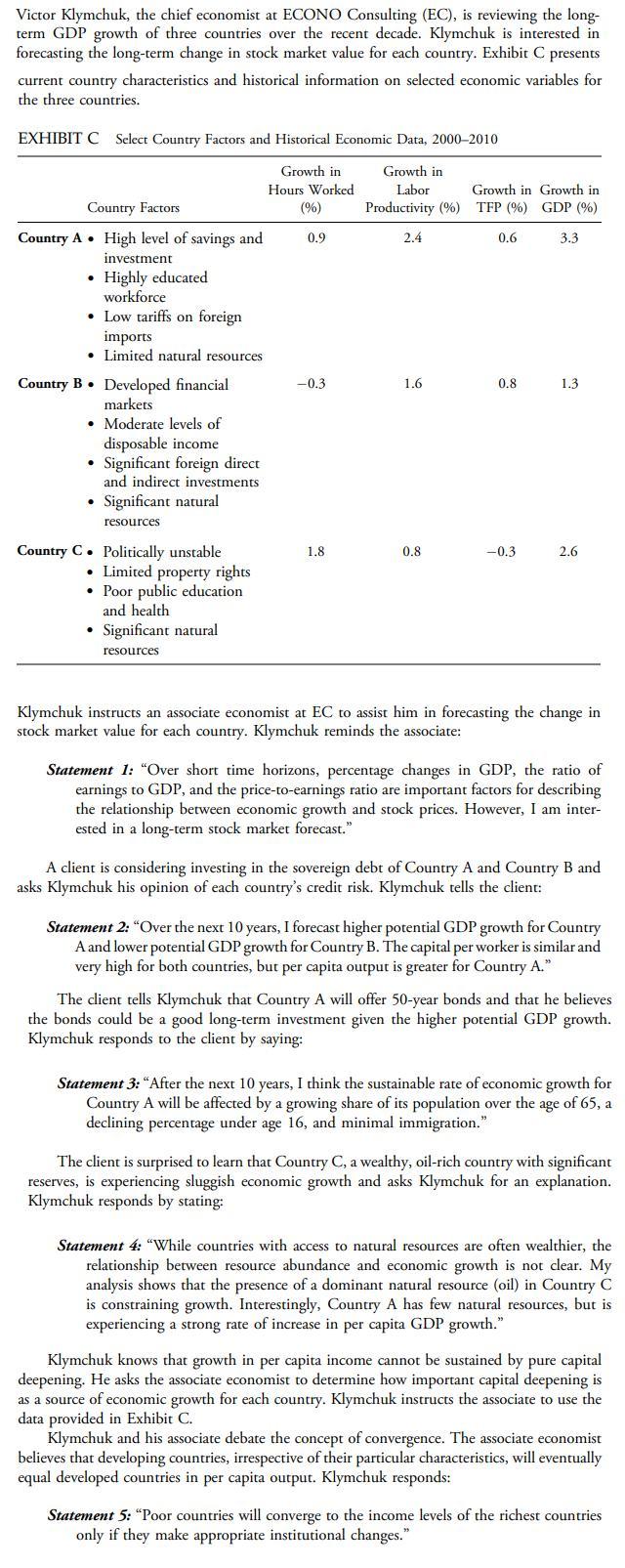

Victor Klymchuk, the chief economist at ECONO Consulting (EC), is reviewing the long- term GDP growth of three countries over the recent decade. Klymchuk is interested in forecasting the long-term change in stock market value for each country. Exhibit C presents current country characteristics and historical information on selected economic variables for the three countries. EXHIBIT C Select Country Factors and Historical Economic Data, 2000-2010 Country Factors Growth in Hours Worked (%) 0.9 Country A High level of savings and investment Highly educated workforce Low tariffs on foreign imports Limited natural resources Country B Developed financial markets Moderate levels of disposable income Significant foreign direct and indirect investments Significant natural resources Country C Politically unstable Limited property rights Poor public education and health Significant natural resources Growth in Labor Growth in Growth in Productivity (%) TFP (%) GDP (%) 2.4 0.6 3.3 -0.3 1.6 0.8 1.3 33 1.8 0.8 -0.3 2.6 Klymchuk instructs an associate economist at EC to assist him in forecasting the change in stock market value for each country. Klymchuk reminds the associate: Statement 1: "Over short time horizons, percentage changes in GDP, the ratio of earnings to GDP, and the price-to-earnings ratio are important factors for describing the relationship between economic growth and stock prices. However, I am inter- ested in a long-term stock market forecast." A client is considering investing in the sovereign debt of Country A and Country B and asks Klymchuk his opinion of each country's credit risk. Klymchuk tells the client: Statement 2: "Over the next 10 years, I forecast higher potential GDP growth for Country A and lower potential GDP growth for Country B. The capital per worker is similar and very high for both countries, but per capita output is greater for Country A." The client tells Klymchuk that Country A will offer 50-year bonds and that he believes the bonds could be a good long-term investment given the higher potential GDP growth. Klymchuk responds to the client by saying: Statement 3: "After the next 10 years, I think the sustainable rate of economic growth for Country A will be affected by a growing share of its population over the age of 65, a declining percentage under age 16, and minimal immigration." The client is surprised to learn that Country C, a wealthy, oil-rich country with significant reserves, is experiencing sluggish economic growth and asks Klymchuk for an explanation. Klymchuk responds by stating: Statement 4: "While countries with access to natural resources are often wealthier, the relationship between resource abundance and economic growth is not clear. My analysis shows that the presence of a dominant natural resource (oil) in Country C is constraining growth. Interestingly, Country A has few natural resources, but is experiencing a strong rate of increase in per capita GDP growth." Klymchuk knows that growth in per capita income cannot be sustained by pure capital deepening. He asks the associate economist to determine how important capital deepening is as a source of economic growth for each country. Klymchuk instructs the associate to use the data provided in Exhibit C. Klymchuk and his associate debate the concept of convergence. The associate economist believes that developing countries, irrespective of their particular characteristics, will eventually equal developed countries in per capita output. Klymchuk responds: Statement 5: "Poor countries will converge to the income levels of the richest countries only if they make appropriate institutional changes."

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

Answered By

HABIBULLAH HABIBULLAH

I have been tutor on chegg for approx 5 months and had solved a lot of questions.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Economics For Investment Decision Makers

ISBN: 9781118111963

1st Edition

Authors: Sandeep Singh, Christopher D Piros, Jerald E Pinto

Question Posted:

Students also viewed these Business questions

-

Based on Statement 4, the higher rate of per capita income growth in Country A is least likely explained by: A. the rate of investment. B. the growth of its population. C. the application of...

-

Note: A free response paper is a short essay which conveys your reaction to article you have read.. Do a free response reflection paper on Lincoln and the Global Economy posted under Week 5....

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Coulson Company is in the process of refinancing some long-term debt. Its fiscal year ends on December 31, 2011, and its financial statements will be issued on March 15, 2012. Under current U.S....

-

Show that the kinetic energy KE of a particle of mass m is related to its momentum p by the equation p = KE2 + 2KE mc2/c.

-

What is system compatibility?

-

A job-scheduling innovation that has helped managers overcome motivation and absenteeism problems associated with a fixed 8-hour workday is a concept called flextime. This flexible working hours...

-

The difference between practical capacity and master-budget capacity utilization is the best measure of managements ability to balance the costs of having too much capacity and having too little...

-

Presented here is the income statement for Big Sky Incorporated for the month of February: Sales $ 61,500 Cost of goods sold 50,500 Gross profit $ 11,000 Operating expenses 14,900 Operating loss $...

-

The type of convergence described by Klymchuk in Statement 5 is best described as: A. club convergence. B. absolute convergence. C. conditional convergence. Victor Klymchuk, the chief economist at...

-

Based on Statement 3, after the next 10 years the growth rate of potential GDP for Country A will most likely be: A. lower. B. higher. C. unchanged. Victor Klymchuk, the chief economist at ECONO...

-

Calculate the book value of a two-year-old machine that cost $200,000, has an estimated residual value of $40,000, and has an estimated useful life of 20,000 machine hours. The company uses...

-

Moving Inc. wants to develop an activity flexible budget for the activity of moving materials. Moving Inc. uses forklifts to move materials from receiving to storeroom and then to production. The...

-

We are in the tail end of Quarter 3 earnings reporting season in the U.S. markets. Roughly 60 percent of companies that have reported their Q3 earnings so far have reported negative earnings relative...

-

Below is a running shock tube illustration. 0.1 0.0 | 0.0 4 4 Diaphragm 1 0.5 Image: Shock tube Initial setup 1 3 2 1 Expansion Head Expansion Tail Slip Shock Surface Image: Running Shock Tube...

-

As you may remember, Holiday Tree Services, Inc. (HTS) has recently entered into a contract with Delish Burger (Delish), whereby HTS is to supply and decorate a Christmas tree in each of Delish...

-

Understanding various types of leadership styles is important in order to determine personal leadership styles. Reflection: Answer both Compare and contrast 2 leadership styles. State the...

-

1. Prepare a briefing report of about four double-spaced pages in which you describe Web services technology in a way that will be understandable to the four department directors. These directors are...

-

If M = 7, s = 2, and X = 9.5, what is z?

-

Is the game shown by Figure in the chapter (not this appendix) a zero-sum game or is it a positive-sum game? How can you tell? Are there dominant strategies in this game? If so, what are they? What...

-

Refer to the payoff matrix in question 8 at the end of this chapter. First, assume this is a one-time game. Explain how the $60/$57 outcome might be achieved through a credible threat. Next, assume...

-

Refer to the payoff matrix below Assuming this is a sequential game with no collusion, what is the outcome if Firm A moves first to build a new type of commercial aircraft? Explain why first-mover...

-

This is a partial adjusted trial batance of Cullumber Compary manualys

-

Which of the following journal entries will record the payment of a $1,500 salaries payable originally incurred for Salaries Expense? Select one: A. Debit Salaries Expense; credit Salaries Payable B....

-

What is the definition of substantially appreciated inventory? A. Inventory with a FMV greater than its basis B. Inventory and unrealized receivables with a FMV greater than their basis C. Inventory...

Study smarter with the SolutionInn App