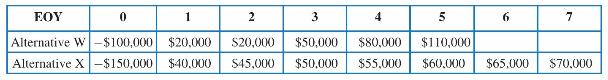

Consider the two one-shot investment alternatives shown in the table below. Neither alternative is expected to be

Question:

Consider the two one-shot investment alternatives shown in the table below. Neither alternative is expected to be available again in the future, but it is expected that investment options returning MARR will always be available.

Determine the following.

a. What is the length of the planning horizon?

b. What measure of worth is preferred?

c. What measure of worth should be avoided?

d. Which alternative is preferred if MARR is 8 percent?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Engineering Economic Analysis

ISBN: 9781118163832

6th Edition

Authors: John A. White, Kenneth E. Case, David B. Pratt

Question Posted: