Repeat Problem 67 using payback period with no discounting (PBP). a. What is the payback period for

Question:

Repeat Problem 67 using payback period with no discounting (PBP).

a. What is the payback period for this investment?

b. If the maximum attractive PBP is 3 years, what is the decision rule for judging the worth of this investment?

c. Should Home Innovations pursue this new product based on PBP?

d. Compare your recommendations resulting from Problems 22, 67, and 68.

Are they consistent? What recommendation would you make to Home Innovations?

Data from problem 22

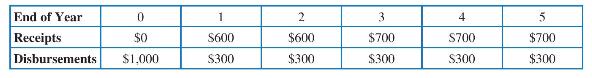

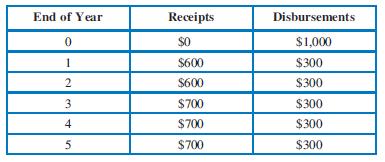

Home Innovation is evaluating a new product design. The estimated receipts and disbursements associated with the new product are shown below. MARR is 10 percent/year.

Data from problem 67

Home Innovations is evaluating a new product design. The estimated receipts and disbursements associated with the new product are shown below. MARR is 10 percent/year.

Step by Step Answer:

Principles Of Engineering Economic Analysis

ISBN: 9781118163832

6th Edition

Authors: John A. White, Kenneth E. Case, David B. Pratt