This problem illustrates how inflation combined with our tax code increases the tax rate on profits. (A

Question:

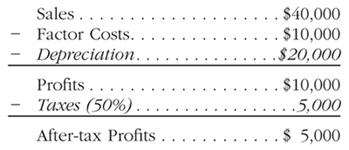

This problem illustrates how inflation combined with our tax code increases the tax rate on profits. (A related fact is that stock prices and inflation have been negatively related in recent years.) In Year 0, the XYZ Corporation buys a $100,000 machine, which will have to be replaced every five years. So it writes off a fifth of the value of the machine each year as depreciation. The following table illustrates its profits in Year 4, assuming there is no inflation.

Now suppose there is inflation, so all prices double (including the replacement cost of the machine, sales, and costs). But the government allows depreciation to be written off at only historical cost (i.e., $20,000). What is the new profit statement in Year 4? What is the effective tax on profits?

Step by Step Answer: