Which of McFadden's predictions in Statement 5 is least correct? A. Prediction 1 B. Prediction 2 C.

Question:

Which of McFadden's predictions in Statement 5 is least correct?

A. Prediction 1 B. Prediction 2 C. Prediction 3

Transcribed Image Text:

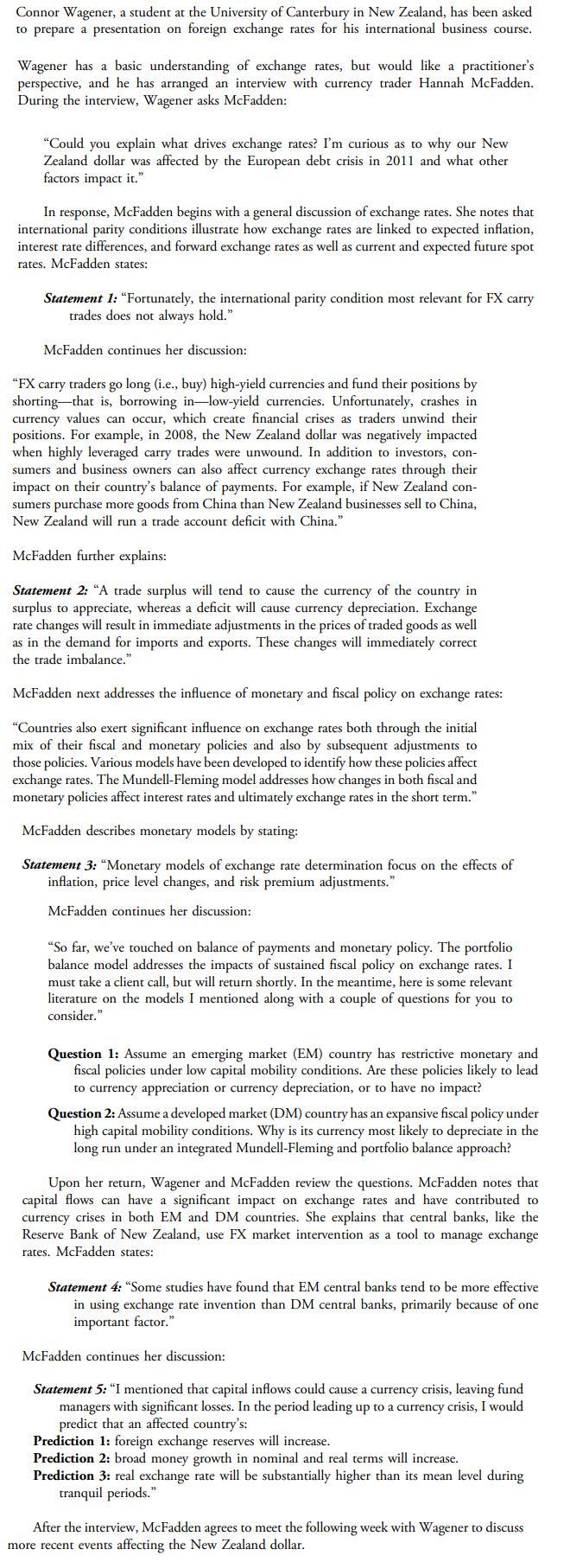

Connor Wagener, a student at the University of Canterbury in New Zealand, has been asked to prepare a presentation on foreign exchange rates for his international business course. Wagener has a basic understanding of exchange rates, but would like a practitioner's perspective, and he has arranged an interview with currency trader Hannah McFadden. During the interview, Wagener asks McFadden: "Could you explain what drives exchange rates? I'm curious as to why our New Zealand dollar was affected by the European debt crisis in 2011 and what other factors impact it." In response, McFadden begins with a general discussion of exchange rates. She notes that international parity conditions illustrate how exchange rates are linked to expected inflation, interest rate differences, and forward exchange rates as well as current and expected future spot rates. McFadden states: Statement 1: "Fortunately, the international parity condition most relevant for FX carry trades does not always hold." McFadden continues her discussion: "FX carry traders go long (i.e., buy) high-yield currencies and fund their positions by shorting that is, borrowing in-low-yield currencies. Unfortunately, crashes in currency values can occur, which create financial crises as traders unwind their positions. For example, in 2008, the New Zealand dollar was negatively impacted when highly leveraged carry trades were unwound. In addition to investors, con- sumers and business owners can also affect currency exchange rates through their impact on their country's balance of payments. For example, if New Zealand con- sumers purchase more goods from China than New Zealand businesses sell to China, New Zealand will run a trade account deficit with China." McFadden further explains: Statement 2: "A trade surplus will tend to cause the currency of the country in surplus to appreciate, whereas a deficit will cause currency depreciation. Exchange rate changes will result in immediate adjustments in the prices of traded goods as well as in the demand for imports and exports. These changes will immediately correct the trade imbalance." McFadden next addresses the influence of monetary and fiscal policy on exchange rates: "Countries also exert significant influence on exchange rates both through the initial mix of their fiscal and monetary policies and also by subsequent adjustments to those policies. Various models have been developed to identify how these policies affect exchange rates. The Mundell-Fleming model addresses how changes in both fiscal and monetary policies affect interest rates and ultimately exchange rates in the short term." McFadden describes monetary models by stating: Statement 3: "Monetary models of exchange rate determination focus on the effects of inflation, price level changes, and risk premium adjustments." McFadden continues her discussion: "So far, we've touched on balance of payments and monetary policy. The portfolio balance model addresses the impacts of sustained fiscal policy on exchange rates. I must take a client call, but will return shortly. In the meantime, here is some relevant literature on the models I mentioned along with a couple of questions for you to consider." Question 1: Assume an emerging market (EM) country has restrictive monetary and fiscal policies under low capital mobility conditions. Are these policies likely to lead to currency appreciation or currency depreciation, or to have no impact? Question 2: Assume a developed market (DM) country has an expansive fiscal policy under high capital mobility conditions. Why is its currency most likely to depreciate in the long run under an integrated Mundell-Fleming and portfolio balance approach? Upon her return, Wagener and McFadden review the questions. McFadden notes that capital flows can have a significant impact on exchange rates and have contributed to currency crises in both EM and DM countries. She explains that central banks, like the Reserve Bank of New Zealand, use FX market intervention as a tool to manage exchange rates. McFadden states: Statement 4: "Some studies have found that EM central banks tend to be more effective in using exchange rate invention than DM central banks, primarily because of one important factor." McFadden continues her discussion: Statement 5: "I mentioned that capital inflows could cause a currency crisis, leaving fund managers with significant losses. In the period leading up to a currency crisis, I would predict that an affected country's: Prediction 1: foreign exchange reserves will increase. Prediction 2: broad money growth in nominal and real terms will increase. Prediction 3: real exchange rate will be substantially higher than its mean level during tranquil periods." After the interview, McFadden agrees to meet the following week with Wagener to discuss more recent events affecting the New Zealand dollar.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

Answered By

Loise Ndungu

I have five years of experience as a writer. As I embark on writing your papers from the prologue to the epilogue, my enthusiasm is driven by the importance of producing a quality product. I put premium product delivery as my top priority, as this is what my clients are seeking and what makes me different from other writers. My goal is to craft a masterpiece each time I embark on a freelance work task! I'm a freelance writer who provides his customers with outstanding and remarkable custom writings on various subjects. Let's work together for perfect grades.

4.90+

82+ Reviews

236+ Question Solved

Related Book For

Economics For Investment Decision Makers

ISBN: 9781118111963

1st Edition

Authors: Sandeep Singh, Christopher D Piros, Jerald E Pinto

Question Posted:

Students also viewed these Business questions

-

The supercritical flow at the toe of a spillway has a depth of 1.12 ft and velocity of 60 ft/s. Determine (a) what type of stilling basin should be used to contain the hydraulic jump; (b) what is the...

-

Swifty Company doses its books on its July 31 year-end. The company does not make entries to accrue for interest except at its year-end. On June 30, the Notes Receivable account balance is $25,600....

-

Let A, B be sets. Define: (a) the Cartesian product (A B) (b) the set of relations R between A and B (c) the identity relation A on the set A [3 marks] Suppose S, T are relations between A and B, and...

-

Indicate identities used n cot20-1 Prove: cot 20 2cot0

-

You travel to a star 135 light-years from Earth at a speed of 2.90 108 m/s. What do you measure this distance to be?

-

Explain how Bayes optimal classifier and the nave Bayes classifier work.

-

Independent random samples are selected from two populations. The data are shown in the table. a. Use the Wilcoxon rank sum test to determine whether the data provide sufficient evidence to indicate...

-

On the first day of its fiscal year, Chin Company issued $10,000,000 of five-year, 7% bonds to finance its operations of producing and selling home improvement products. Interest is payable...

-

1 . Discuss important attributes for a screening model to possess when evaluating projects

-

Based on Exhibit A, the factor that would most likely have the greatest positive impact on the per capita GDP growth of Country A is: A. free trade. B. technology. C. saving and investment. Hans...

-

The factor that McFadden is most likely referring to in Statement 4 is: A. FX reserve levels. B. domestic demand. C. the level of capital flows. Connor Wagener, a student at the University of...

-

Columbia Sportswear Company's financial statements are presented in Appendix B. Financial statements of VF Corporation are presented in Appendix C. Instructions (a) Based on the information in these...

-

Claxton, Inc. paid a dividend of $ 0 . 9 5 per common share every December from 2 0 0 9 through 2 0 2 3 . The dividend is expected to continue at that level in 2 0 2 4 and 2 0 2 5 . In 2 0 2 6 and...

-

1. Who are two (2) specific examples of effective leaders (who you know personally) who have impacted your life? 2. What made them "effective" leaders? What many specific traits did these leaders...

-

pr Hwk12 Consider the differebtiable function F(x) whose instantaneous rates are given by the table of values below: I 3.00 3.50 4.00 4.50 5.00 5.50 6.00 6.50 7.00 F'(x) 21.00 27.50 35.00 43.50 53.00...

-

A stone was dropped off a cliff and hit the ground with a speed of 152 ft/s. What is the height of the cliff? (Use 32 ft/s for the acceleration due to gravity.) Step 1 We know that s(t) = 1 at + vot...

-

The 150 m long beam is submitted to a distributed load w(x) = (0.05 x 2) + 10 N/m. 50 50 w(x) 100 150 What is the moment about the point O in kN.m created by the distributed load? O-25.7 kN.m O-249...

-

In researching Web server computers, you find that many companies that sell these computers offer a configuration option for controlling computers disk drives called RAID. Using the Web and your...

-

Use the method of Example 4.29 to compute the indicated power of the matrix. 1 0 1

-

How does the problem of limited and bundled choice in the public sector relate to economic efficiency? Why are public bureaucracies alleged to be less efficient than private enterprises?

-

Distinguish between the benefits-received and the ability-to-pay principles of taxation. Which philosophy is more evident in our present tax structure? Justify your answer. To which principle of...

-

What is meant by a progressive tax? A regressive tax? A proportional tax? Comment on the progressivity or regressivity of each of the following taxes, indicating in each case where you think the tax...

-

Questien It Calraluta bae neark yoe cen atforal to berren

-

In calculating the net present value of a proposed project, the cash flows of the project should include a.) amortization of goodwill b.) interest expenses paid to bondholders c.) extra working...

-

If Yolanda's insurance company cancels her fire insurance policy after 204 days, how much of the $682.00 annual premium will she receive as a refund (in $)? (Round you answer to the nearest cent.) $

Study smarter with the SolutionInn App