Which of the plans in exercise 1.3 would impose the larger burden on those with incomes under

Question:

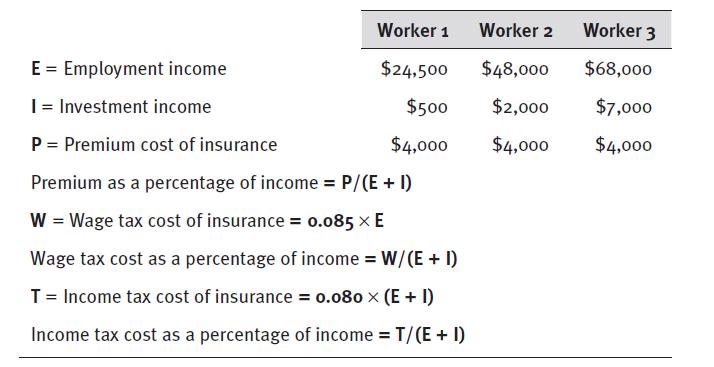

Which of the plans in exercise 1.3 would impose the larger burden on those with incomes under $25,000: a mandatory insurance plan financed via premiums, via the income tax, or via a payroll tax?

Exercise 1.3

A mandatory health insurance plan costs $4,000. One worker earns $24,500 in employment income and $500 in investment income. Another worker earns $48,000 in employment income and $2,000 in investment income. A third worker earns $68,000 in employment income and $7,000 in investment income. A premium-based system would cost each worker $4,000. A wage tax–based system would cost each worker 8.5 percent of wages. An income tax–based system would cost each worker 8 percent of income. For each worker, calculate the cost of the insurance as a share of total income.

Step by Step Answer: