Based on the following information about Banks A and B, compute for each bank its return on

Question:

Based on the following information about Banks A and B, compute for each bank its return on assets (ROA), return on equity (ROE), and leverage ratio.

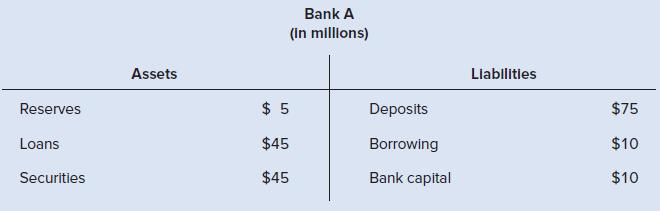

a. Bank A has net profit after taxes of $1.8 million and the following balance sheet:

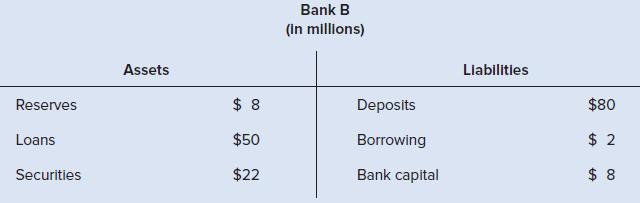

b. Bank B has net profit after taxes of $1 million and the following balance sheet:

Transcribed Image Text:

Bank A (in millions) Assets Liabilities Reserves $ 5 Deposits $75 Loans $45 Borrowing $10 Securities $45 Bank capital $10

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

Return on Assets ROA ROA measures how efficiently a company uses its asse...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Money Banking And Financial Markets

ISBN: 9781260226782

6th Edition

Authors: Stephen Cecchetti, Kermit Schoenholtz

Question Posted:

Students also viewed these Business questions

-

Based on the information provided below about banks A and B, compute for each bank its return on assets (ROA), return on equity (ROE) and leverage ratio. a. Bank A has net profit after taxes of $1.8...

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

Based on the information provided below about banks A and B, compute for each bank its return on assets (ROA), return on equity (ROE) and leverage ratio. a. Bank A has net profit after taxes of $1.8...

-

What will the following code display? numbers = [1, 2, 3, 4, 5] numbers [2] = 99 print (numbers)

-

1. Why might it be difficult to measure natural resource depletion or pollution and convert the resulting quantity into a dollar-denominated amount? 2. Why do you suppose that many economists worry...

-

Having had experience in metal handling, John Douglass decided to invest a part of his savings, form his own company, and be his own boss. He realizes that his company will have to be small,...

-

Explain how we determine the principal and interest amounts for the Loans problem.

-

Determine whether each of the following costs should be classified as direct materials (DM), direct labor (DL), or manufacturing overhead (MO). (a) ____Frames and tires used in manufacturing...

-

We are evaluating a project that costs $604,100, has a seven-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected...

-

Why are checking accounts no longer the primary source of funds for commercial banks in the United States?

-

Consider a bank with the following balance sheet, as shown on the next page. You read online that the banks return on assets (ROA) was 1 percent. What were the banks after-tax profits? Bank Balance...

-

Kosinksi Manufacturing carries no inventories. Its product is manufactured only when a customer's order is received. It is then shipped immediately after it is made. For its fiscal year ended October...

-

Write a function that takes as input a non-negative integer in the range 0 to 99 and returns the English word(s) for the number as a string. Multiple words should be separated by a space. If the...

-

The Event Manager sighed as the festival approached and she had only five crafts vendors who had committed to taking part in the marketplace. She and her assistant were frantic. They had been...

-

the systematic recording, analysis, and interpretation of costs incurred by a business. Its significance extends beyond mere financial tracking; it plays a pivotal role in aiding management...

-

1.What is your process for ensuring that all your work is correct? 2.What do you mean by Batch Costing ? 3.Explain the accounting procedure for Batch Costing 4.State the applicability of Job Costing...

-

The increasing occurrence of freak weather incidents will have both local and global effects. Even in cases where production has been re-localized, freak weather can still greatly impact local...

-

What is the duration of a bond with a par value of $ 10,000 that has a coupon rate of 3.5 percent annually and a final maturity of two years? Assume that the required rate of return is 4 percent...

-

Calculate the Lagrange polynomial P 2 (x) for the values (1.00) = 1.0000, (1.02) = 0.9888, (1.04) = 0.9784 of the gamma function [(24) in App. A3.1] and from it approximations of (1.01) and (1.03).

-

If velocity were predictable but not constant, would a monetary policy that fixed the growth rate of money work?

-

Describe the impact of financial innovations on the demand for money and velocity.

-

Suppose that expected inflation rises by 3 percent at the same time that the yields on money and on non-money assets both rise by 3 percent. What will happen to the demand for money? What if expected...

-

Just work out the assignment on your own sheet, you dont need the excel worksheet. Classic Coffee Company Best friends, Nathan and Cody, decided to start their own business which would bring great...

-

Financial information related to the proprietorship of Ebony Interiors for February and March 2019 is as follows: February 29, 2019 March 31, 2019 Accounts payable $310,000 $400,000 Accounts...

-

(b) The directors of Maureen Company are considering two mutually exclusive investment projects. Both projects concern the purchase of a new plant. The following data are available for each project...

Study smarter with the SolutionInn App