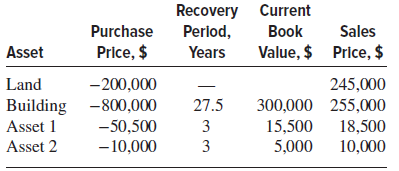

A couple of years ago, the company Health4All purchased land, a building, and two depreciable assets from

Question:

Transcribed Image Text:

Recovery Current Perlod, Purchase Book Sales Price, $ Value, $ Price, $ Asset Years Land -200,000 -800,000 -50,500 -10,000 245,000 300,000 255,000 Building 27.5 Asset 1 3 15,500 5,000 18,500 10,000 Asset 2 3

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (8 reviews)

Land CG 45000 Building CL 4...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Andrea Reed is in her fourth year at a business school in Nova Scotia. Recently, Andrea was asked by her brother Nathan to help him prepare a personal balance sheet. Nathan needed the balance sheet...

-

You, CA, an audit senior at Grey & Co., Chartered Accountants, are in charge of this year's audit of Plex-Fame Corporation (PFC). PFC is a rapidly expanding, diversified, publicly owned entertainment...

-

You are engaged in the audit of Plex-Fame Corporation (PFC), a rapidly expanding, diversified, publicly traded entertainment company with operations throughout Canada and the United States. PFCs...

-

Jack Hammer invests in a stock that will pay dividends of $2.00 at the end of the first year; $2.20 at the end of the second year; and $2.40 at the end of the third year. Also, he believes that at...

-

Materials used by the Instrument Division of T_Kong Industries are currently purchased from outside suppliers at a cost of $175 per unit. However, the same materials are available from the Components...

-

Marcello Construction Co. uses the job order cost system. In recording payroll transactions, the following accounts are used: Cash Wages Payable FICA Tax Payable Federal Unemployment Tax Payable...

-

Discuss your favorite theme park with your class. Explain why it is your favorite. LO.1

-

Refer to the Amazon.com financial statements, including Notes 1 and 3, in Appendix A at the end of this book. Answer the following questions. Requirements 1. Which depreciation method does Amazon use...

-

15. 16. 17. 15 Required Compute the cash proceeds from bond issues under the following terms. For each case, indicate whether the bonds sold at a premium or discount Cash Proceeds Discount or Premium...

-

Pizza Corporation acquired 80 percent ownership of Slice Products Company on January 1, 20X1, for $160,000. On that date, the fair value of the noncontrolling interest was $40,000, and Slice reported...

-

An engineer who made an annual return of 8% after taxes on a stock investment was told by his accountant that this is equivalent to a 12% per year before-tax return. What percentage of taxable income...

-

A nanotube forming asset was purchased 3 years ago for $240,000. It was just sold for $285,000. The asset was depreciated by the MACRS method with n = 5 years and has a current book value of $69,120....

-

In most of the examples discussed in chapter 5, we saw a close match between the characteristics of organisms and their environment. However, natural selection does not always produce an optimal, or...

-

The Purple Company This project will give you an opportunity to apply your knowledge of accounting principles and procedures to a corporation. You will handle the accounting work of The Purple...

-

Comprehensive Problem Bug-Off Exterminators (Algo) Bug-Off Exterminators provides pest control services and sells extermination products manufactured by other companies. Following is the company's...

-

The Michigan Company has made the following information available for its production facility for the month of June. Fixed overhead was estimated at 19,000 machine hours for the production cycle....

-

Question 1 Copper Explorations recently acquired the rights to mine a new site. Machinery, equipment and a truck were purchased to begin the mining operations at the site. Details of the assets for...

-

Large Data Sets from Appendix B. In Exercises 25-28, refer to the indicated data set in Appendix B. Use software or a calculator to find the means and medians. [Data Set] Weights Use the weights of...

-

Netflix acquires a small upscale restaurant in New York. Identify the type of growth strategy described by each statement. A. Concentration B. Related diversification C. Forward integration D....

-

If a test has high reliability. O the test measures what the authors of the test claim it measures O people who take the same test twice get approximately the same scores both times O scores on the...

-

For independent projects identified as W, X, Y, and Z, develop all of the mutually exclusive bundles. Projects X and Y perform the same function with different processes; both should not be selected.

-

Five projects have been identified for possible implementation by a company that makes dry ice blasters-machines that propel tiny dry ice pellets at supersonic speeds so they fl ash-freeze and then...

-

Four independent projects (1, 2, 3, and 4) are proposed for investment by Perfect Manufacturing, Inc. List all the acceptable mutually exclusive bundles based on the following selection restrictions...

-

explain in excel please For a particular product the price per unit is $6. Calculate Revenue if sales in current period is 200 units. Conduct a data analysis, on revenue by changing the number of...

-

Hall Company sells merchandise with a one-year warranty. In the current year, sales consist of 35,000 units. It is estimated that warranty repairs will average $10 per unit sold and 30% of the...

-

Q 4- Crane Corporation, an amusement park, is considering a capital investment in a new exhibit. The exhibit would cost $ 167,270 and have an estimated useful life of 7 years. It can be sold for $...

Study smarter with the SolutionInn App