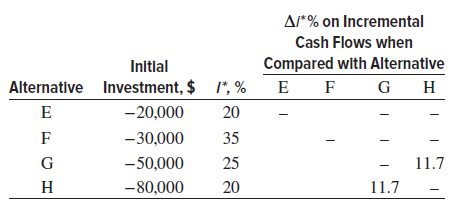

A rate of return analysis was initiated for the infinite- life alternatives shown below. (a) Fill in

Question:

(a) Fill in the 10 blanks in the incremental rate of return (Δi*) columns.

(b) How much revenue is associated with each alternative?

(c) Which alternative should be selected if they are mutually exclusive and MARR is 16% per year?

(d) Which alternative should be selected if they are mutually exclusive and MARR is 11% per year?

(e) Select the two best alternatives at MARR = 19% per year.

Minimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: