Joyce and Vincent, both engineers, got married and raised three children over an 18-year period and the

Question:

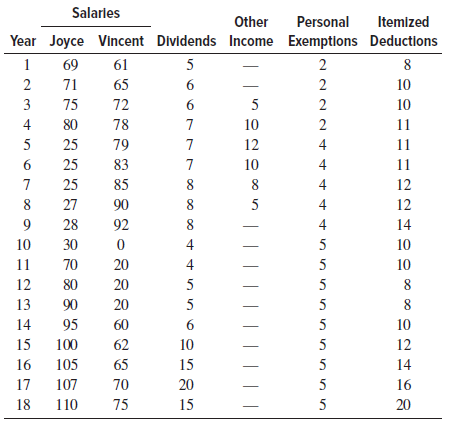

The two have summarized the basic information from their tax returns for the 18 years. They wonder what percentage of their gross income has gone to federal taxes over the years. Apply the tax rate in the latest IRS Publication 17 (www.irs.gov) for married, filing jointly to calculate their taxes each year using a spreadsheet and plot the percentage of GI.

Assume exemptions are deducted as follows for each person (adult or child): years 1 to 8, $3500; years 9 to 14, $4000; years 15 to 18, $4500. (All monetary amounts are in $1000 units.)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: