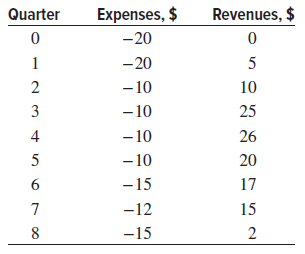

One of your employees presented you the cash flow estimates (in $1000 units) for a new method

Question:

(a) Apply the rule of signs to determine the maximum number of possible i* values at aMARR of 5% per quarter.

(b) Apply Norstrom€™s criterion to determine if there is only one positive rate of return value.

(c) Is it possible to determine a positive i* for this net cash flow series that meets the MARR? Why or why not?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: