The following mutually exclusive investment alter-natives have been presented to you. (See Table P6-82.) The life of

Question:

(a) Do nothing

(b) Alt. A

(c) Alt. B

(d) Alt. C

(e) Alt. D

(f) Alt. E

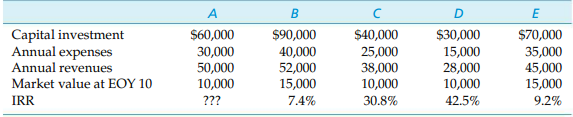

Table P6-82:

Minimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other...

Transcribed Image Text:

Capital investment Annual expenses Annual revenues Market value at EOY 10 IRR $40,000 25,000 38,000 10,000 30.8% $60,000 $90,000 $30,000 $70,000 30,000 28,000 52,000 15,000 45,000 15,000 9.2% 10,000 ??? 10,000 42.5% 7.4%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (15 reviews)

Eliminate Alt B and Alt E IRR 15 PW A 15 600...View the full answer

Answered By

Saikumar Ramagiri

Financial accounting:- Journal and ledgers, preparation of trail balance and adjusted trail balance Preparation of income statement, retained earning statement and balance sheet Banks reconciliation statements Financial statement analysis Cash flow statement analysis (both direct and indirect methods) All methods of Depreciations Management Accounting:- Ratios Budgeting control Cash budget and production budget Working capital management Receivable management Costing:- Standard and variance costing Marginal costing and decision making Cost-volume-profit analysis Inventory management (LIFO, FIFO) Preparation and estimation of cost sheet Portfolio management:- Calculation of portfolio standard deviation or risk Calculation of portfolio expected returns CAPM, Beta Financial management:- Time value of money Capital budgeting Cost of capital Leverage analysis and capital structure policies Dividend policy Bond value calculations like YTM, current yield etc International finance:- Derivatives Futures and options Swaps and forwards Business problems Finance problems Education (mention all your degrees, year awarded, Institute/University, field(s) of major): Education Qualification Board/Institution/ University Month/Year of Passing % Secured OPTIONALS/ Major ICWAI(inter) ICWAI inter Pursuing Pursuing - M.com(Finance) Osmania University June 2007 65 Finance & Taxation M B A (Finance) Osmania University Dec 2004 66 Finance & Marketing. B.Com Osmania University June 2002 72 Income Tax, Cost & Mgt, Accountancy, Auditing. Intermediate (XII) Board of Intermediate May 1999 58 Mathematics, Accountancy, Economics. S S C (X) S S C Board. May 1997 74 Mathematics, Social Studies, Science. Tutoring experience: • 10 year experience in online trouble shooting problems related to finance/accountancy. • Since 6 Years working with solution inn as a tutor, I have solved thousands of questions, quick and accuracy Skills (optional): Technical Exposure: MS Office, SQL, Tally, Wings, Focus, Programming with C Financial : Portfolio/Financial Management, Ratio Analysis, Capital Budgeting Stock Valuation & Dividend Policy, Bond Valuations Individual Skills : Proactive Nature, Self Motivative, Clear thought process, Quick problem solving skills, flexible to complex situations. Achievements : 1. I have received an Award certificate from Local Area MLA for the cause of getting 100% marks in Accountancy during my Graduation. 2. I have received a GOLD MEDAL/Scholarship from Home Minister in my MBA for being the “Top Rank student “ of management institute. 3. I received numerous complements and extra pay from various students for trouble shooting their online problems. Other interests/Hobbies (optional): ? Web Surfing ? Sports ? Watching Comics, News channels ? Miniature Collection ? Exploring hidden facts ? Solving riddles and puzzles

4.80+

391+ Reviews

552+ Question Solved

Related Book For

Engineering Economy

ISBN: 978-0133439274

16th edition

Authors: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Question Posted:

Students also viewed these Business questions

-

Five mutually exclusive investment alternatives have been proposed. Based on benefit-cost ratio analysis, and a MARR of 15%, which alternative should be selected? Year A B CDE F 0$200 $125 $100 $125...

-

Quattro, Inc. has the following mutually exclusive projects available. The company has historically used a 4-year cutoff for projects. The required return is 11 percent. a. Compute the payback for...

-

Fuji Software, Inc., has the following mutually exclusive projects. a. Suppose Fujis payback period cutoff is two years. Which of these two projects should be chosen? b. Suppose Fuji uses the NPV...

-

Discuss any of the established brands of the business concerned with woolworths in Australia

-

Hardwick Enterprises is evaluating alternative uses for a three-story manufacturing and warehousing building that it has purchased for $1,250,000. The company can continue to rent the building to the...

-

Interpreting common-size income statements Exhibit 4.7 presents common-size income statements for Standard Denim and Blue Label Jeans, two apparel retailing firms, for three recent years. In addition...

-

Even if all the points on an x@chart fall between the control limits, the process may be out of control. Explain.

-

A telemarketing firm has studied the effects of two factors on the response to its television advertisements. The first factor is the time of day at which the ad is run, while the second is the...

-

Assume a car dealer has demand for 1,000 cars per year. The unit purchase cost is $20,000. The fixed cost for each order of cars is $5,000. It takes 2.5 weeks to receive an order. The holding cost...

-

A B C D E 1 Account Debit Credit Impact on current ratio Impact on profit margin 2 Payroll expense 72,000 3 Accrued payroll 72,000 4 5 Depreciation expense 125,000 6 Accumulated depreciation 125,000...

-

The following mutually exclusive investment alter-natives have been presented to you. (See Table P6-82.) The life of all alternatives is 10 years. After the base alternative has been identified, the...

-

Consider the mutually exclusive alternatives given in the table below. The MARR is 10% per year. Assuming repeatability, which alternative should the company select? (a) Alternative X (b) Alternative...

-

Explain how executive leadership is an important part of strategic management. AppendixLO1

-

Listed in the accompanying table are waiting times (seconds) of observed cars at a Delaware inspection station. The data from two waiting lines are real observations, and the data from the sir line...

-

Franklin Prepared Foods (FPF) sells three varieties of microwaveable meals with the following prices and costs: Variable Cost Fixed Cost per Meat Fish Vegetarian Entire firm Selling Price per Case: $...

-

Isabella is a 14-year-old Hispanic bisexual female who has come into the Department of Child Safety (DCS) care due to neglect. Isabella's mother, Martina, is 35 years old, a single mother, has an...

-

Jeff is able to ride a bicycle although he hasn't ridden one for a few years, thanks to his: ( A ) procedural memory ( B ) episodic memory C ) semantic memory ( D ) cognitive memory

-

1. Allen Young has always been proud of his personal investment strategies and has done very well over the past several years. He invests primarily in the stock market. Over the past several months,...

-

Find the constants a and b that maximize the value of Explain your reasoning. Ja (1-x) dx.

-

ABC company leased new advanced computer equipment to STU Ltd on 1 January 2019.STULtd has to pay annual rental of $290,000 starting at 1 January 2019. It is a four years lease with ultimate rental...

-

Income from a precious metals mining operation has been decreasing uniformly for 5 years. If income in year 1 was $300,000 and it decreased by $30,000 per year through year 4, the annual worth of the...

-

If you are able to save $5000 in year 1, $5150 in year 2, and amounts increasing by 3% each year through year 20, the amount you will have at the end of year 20 at 10% per year interest is closest...

-

During the last week, Sundara has read about different situations that involve money, interest rate, and different amounts of time. She has gotten interested in the major effects that time and...

-

Bought an old van for 4000 from Peters promising to pay laterwhat is the transactions

-

Company has a following trade credit policy 1/10 N45. If you can borrow from a bank at 9,5% annual rate, would it be beneficial to borrow money and pay off invoices earlier?

-

Given the following exchange rates, which of the multiple-choice choices represents a potentially profitable inter-market arbitrage opportunity? 129.87/$1.1226/$0.00864/ 114.96/ B $0.8908/ (C)...

Study smarter with the SolutionInn App