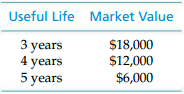

The market value of a certain asset depends upon its useful life as follows: a. The asset

Question:

a. The asset requires a capital investment of $120,000, and MARR is 15% per year. Use Monte Carlo simulation and generate four trial outcomes to find its expected equivalent AW if each useful life is equally likely to occur.

b. Set up an equation to determine the variance of the asset€™s AW.

Monte Carlo simulation is a technique used to understand the impact of risk and uncertainty in financial, project management, cost, and other forecasting models. A Monte Carlo simulator helps one visualize most or all of the potential outcomes to... MARR

Minimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Engineering Economy

ISBN: 978-0133439274

16th edition

Authors: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Question Posted: