The EnCal Corporation is a small, West Coastbased power company specializing in power generation methods that use

Question:

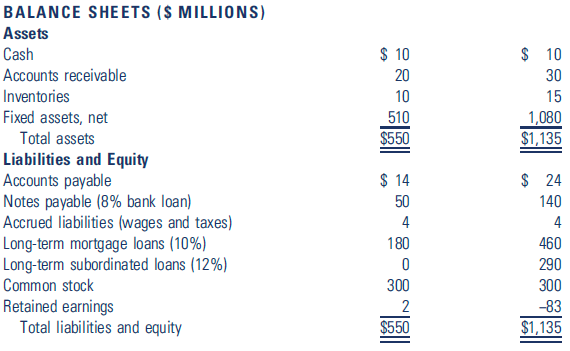

A financial restructuring that would reduce EnCal€™s debt burden has been proposed. The proposal is to reduce the interest rate on its bank loan to 6 percent and loan principal to $100 million, to reduce the interest rate on its mortgage loans to 8 percent, and to replace all of its subordinated loan balance with a 50 percent equity stake in the company.

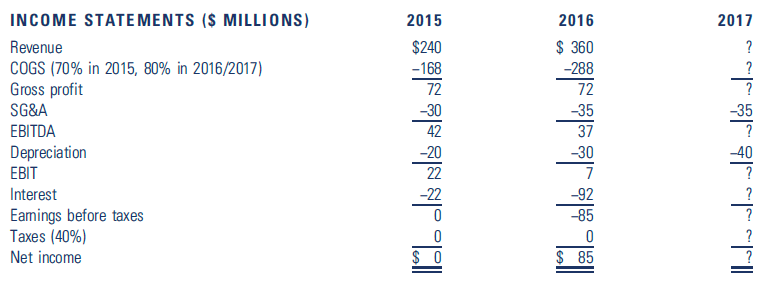

A. Assuming a 25 percent increase in revenue with no additional capital investment, what will EnCal€™s new income statement and balance sheet look like in the business as usual and financial restructuring scenarios?

B. Will EnCal be able to service its debt under either scenario?

C. Would EnCal be a likely candidate for Chapter 7 bankruptcy?

D. Suppose the governor has called an emergency legislative session on the utility€™s behalf to prevent its eventual bankruptcy. If the governor is able to get a bill passed supporting a rate hike on electrical power, how much must EnCal charge per kilowatt if it is going to be able to cover its interest payments under the new financial restructuring plan? Assume EnCal€™s power generation facilities have a maximum capacity of 800 megawatts with an average capacity utilization of 50 percent.

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Entrepreneurial Finance

ISBN: 978-1305968356

6th edition

Authors: J. Chris Leach, Ronald W. Melicher