An asset is expected to generate cash flows of ($100) in one year, ($150) in two years,

Question:

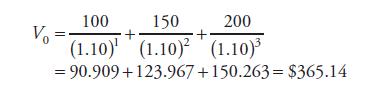

An asset is expected to generate cash flows of \($100\) in one year, \($150\) in two years, and \($200\) in three years. The value of this asset today, using a 10 percent discount rate, is

The value at t = 0 is \($365.14\). The same logic is used to value an asset at a future date.

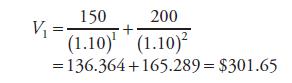

The value of the asset at t = 1 is the present value, discounted back to t = 1, of all cash flows after this point. This value, V1, is

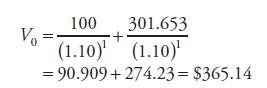

At any point in time, the asset’s value is the value of future cash flows (CF) discounted back to that point. Because V1 represents the value of CF2 and CF3 at t = 1, the value of the asset at t = 0 is also the present value of CF1 and V1:

Finding V0 as the present value of CF1, CF2, and CF3 is logically equivalent to finding V0 as the present value of CF1 and V1.

Step by Step Answer: