As a health care analyst, you are valuing the stocks of three medical equipment manufacturers, including the

Question:

As a health care analyst, you are valuing the stocks of three medical equipment manufacturers, including the Swedish company Getinge AB (Stockholm: GETI) in March 2013.

Based on an average of estimates obtained from capital asset pricing model (CAPM)

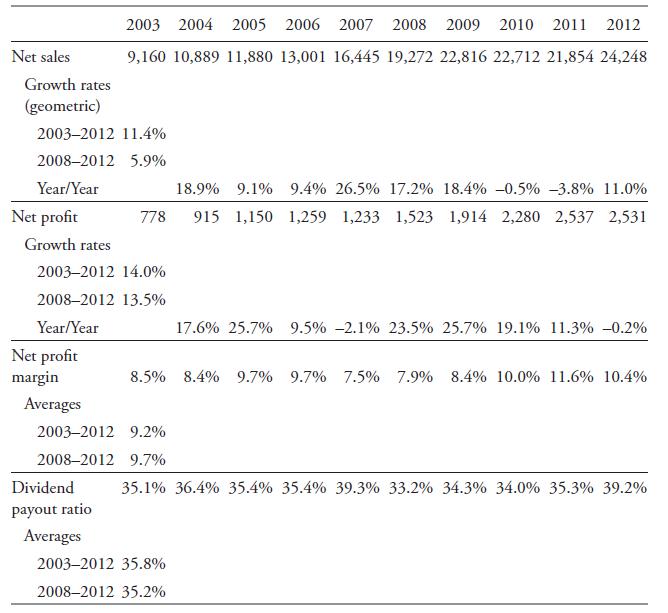

and bond yield plus risk premium approaches, you estimate that GETI’s required rate of return is 9 percent. You have gathered the following data from GETI’s 2012 annual report (amounts in millions of Swedish krona, or SEK):

Although sales growth picked up in 2012, it has slowed considerably in recent years and you are concerned that trend will ultimately be reflected in profit margins. Given this consideration, you make the following long-term forecasts:

Profit margin = 9.0 percent Dividend payout ratio = 35.0 percent Earnings growth rate = 7.0 percent i. Based on these data, calculate GETI’s justified P/S.

ii. Given a forecast of GETI’s sales per share (in Swedish krona) for 2013 of SEK108.9, estimate the intrinsic value of GETI stock.

iii. Given a market price for GETI of SEK196.2 on 31 March 2013 and your answer to Part 2, determine whether GETI stock appears to be fairly valued, overvalued, or undervalued.

Step by Step Answer: