As a technology analyst, you are working on the valuation of Western Digital (NYSE: WDC), a manufacturer

Question:

As a technology analyst, you are working on the valuation of Western Digital (NYSE:

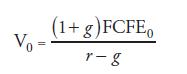

WDC), a manufacturer of hard disk drives. As a first estimate of value, you are applying a FCFE model under the assumption of a stable long-term growth rate in FCFE:

where g is the expected growth rate of FCFE. You estimate trailing FCFE at \($7.96\) per share and trailing CF (based on the earnings plus noncash charges definition) at \($12.00\) .

Your other estimates are a 12.0 percent required rate of return and a 3.0 percent expected growth rate of FCFE.

i. What is the intrinsic value of WDC according to a constant-growth FCFE model?

ii. What is the justified P/CF based on forecasted fundamentals?

iii. What is the justified P/FCFE based on forecasted fundamentals?

Step by Step Answer: