Assume a company with no real earnings growth, such that its earnings growth can result only from

Question:

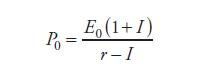

Assume a company with no real earnings growth, such that its earnings growth can result only from inflation, will pay out all its earnings as dividends. Based on the Gordon

(constant growth) DDM, the value of a share is:

where:

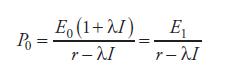

P0 = current price, which is substituted for the intrinsic value, V0, for purposes of analyzing a justified P/E E0 = current EPS, which is substituted for current dividends per share, D0, because the assumption in this example is that all earnings are paid out as dividends I= rate of inflation, which is substituted for expected growth, g, because of the assumption in this example that the company’s only growth is from inflation r = required return Suppose the company has the ability to pass on some or all inflation to its customers and let λ represent the percentage of inflation in costs that the company can pass through to revenue. The company’s earnings growth may then be expressed as λI and the equation becomes

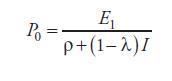

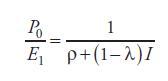

Now, introduce a real rate of return, defined here as r minus I and represented as ρ. The value of a share and the justified forward P/E can now be expressed, respectively, as follows:30

and

If a company can pass through all inflation, so that λ = 1 (100 percent), then the P/E is equal to 1/ρ. But if the company can pass through no inflation, so that λ = 0, then the P/E is equal to 1/(ρ + I)—that is, 1/r.

You are analyzing two companies, Company M and Company P. The real rate of return required on the shares of Company M and Company P is 3 percent per year.

Using the analytic framework provided, address the following:

i. Suppose both Company M and Company P can pass through 75 percent of cost increases. Cost inflation is 6 percent for Company M but only 2 percent for Company P.

A. Estimate the justified P/E for each company.

B. Interpret your answer to Part A.

ii. Suppose both Company M and Company P face 6 percent a year inflation. Company M can pass through 90 percent of cost increases, but Company P can pass through only 70 percent.

A. Estimate the justified P/E for each company.

B. Interpret your answer to Part A.

Step by Step Answer: