Cane Distribution, Inc., incorporated on 31 December 2009 with initial capital infusions of ($224),000 of debt and

Question:

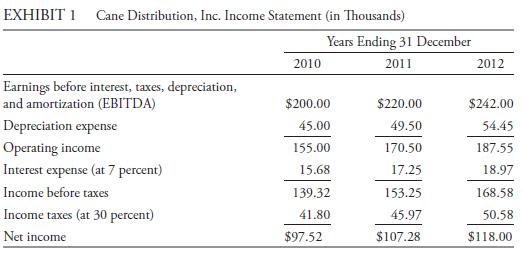

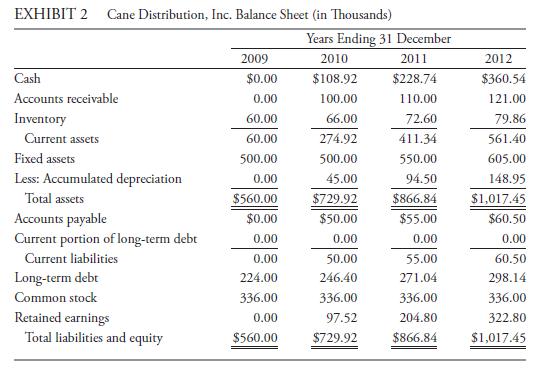

Cane Distribution, Inc., incorporated on 31 December 2009 with initial capital infusions of \($224\),000 of debt and \($336\),000 of common stock, acts as a distributor of industrial goods. The company managers immediately invested the initial capital in fixed capital of

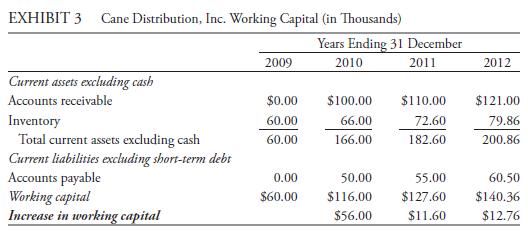

\($500\),000 and working capital of \($60\),000. Working capital initially consisted solely of inventory. The fixed capital consisted of nondepreciable property of \($50\),000 and depreciable property of \($450\),000. The depreciable property has a 10-year useful life with no salvage value. Exhibits 1, 2, and 3 provide Cane’s financial statements for the three years following incorporation. Starting with net income, calculate Cane’s FCFF for each year.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: