Carl Zeiss Meditec AG (Deutsche Brse XETRA: AFX), 65 percent owned by the Carl Zeiss Group, provides

Question:

Carl Zeiss Meditec AG (Deutsche Börse XETRA: AFX), 65 percent owned by the Carl Zeiss Group, provides screening, diagnostic, and therapeutic systems for the treatment of ophthalmologic (vision) problems. Reviewing the issue as of mid-August 2013, when it is trading for €23.37, Hans Mattern, a buy-side analyst covering Meditec, forecasts that the current dividend of €0.40 will grow by 9 percent per year during the next 10 years. Thereafter, Mattern believes that the growth rate will decline to 5 percent and remain at that level indefinitely.

Mattern estimates Meditec’s required return on equity as 7.1 percent based on a beta of 0.90 against the DAX, a 2.4 percent risk-free rate, and his equity risk premium estimate of 5.2 percent.

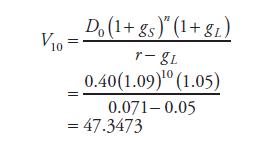

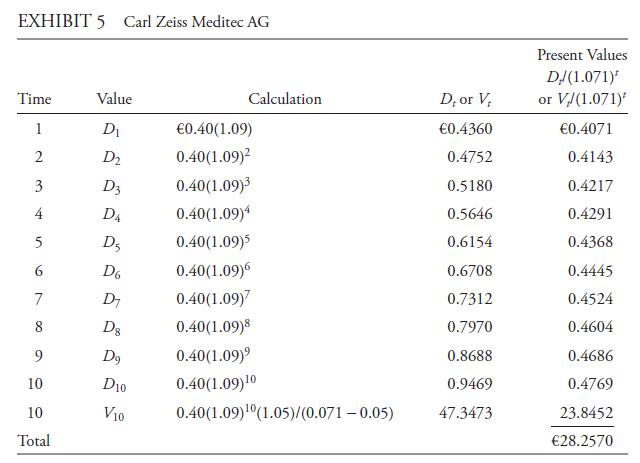

Exhibit 5 shows the calculations of the first ten dividends and their present values discounted at 7.1 percent. The terminal stock value at t = 10 is

The terminal stock value and its present value are also given.

In this two-stage model, the dividends are forecast during the first stage, and then their present values are calculated. The Gordon growth model is used to derive the terminal value (the value of the dividends in the second stage as of the beginning of that stage). As shown in Exhibit 5, the terminal value is V10 = D11/(r − gL). Ignoring rounding errors, the Period 11 dividend is €0.9943 (= D10 × 1.05 = €0.9479 × 1.05).

By using the standard Gordon growth model, V10 = €47.3473 = €0.9943/(0.071 −

0.05). The present value of the terminal value is €23.8452 = €47.3473/1.07110. The total estimated value of Meditec is €28.26 using this model. Notice that approximately 84 percent of this value, €23.85, is the present value of V10, and the balance, €28.26 −

€23.85 = €4.41, is the present value of the first ten dividends. Recalling the discussion of the sensitivity of the Gordon growth model to changes in the inputs, an interval for the intrinsic value of Meditec could be calculated by varying the mature growth rate through the range of plausible values.

Step by Step Answer: