Donaldson Company, Inc. (NYSE: DCI) is one of the largest and most successful filtration manufacturers in the

Question:

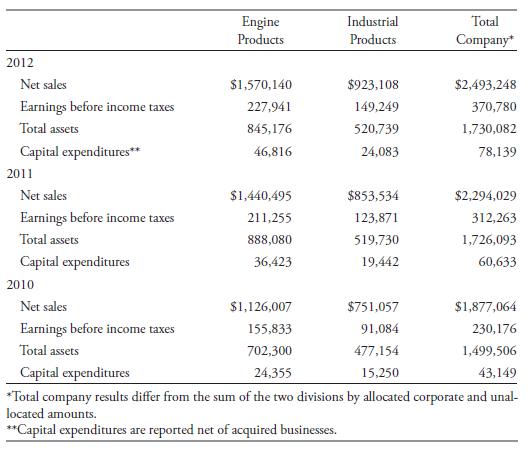

Donaldson Company, Inc. (NYSE: DCI) is one of the largest and most successful filtration manufacturers in the world. Consistent with FASB guidance related to segment reporting, the company has identified two reportable segments: Engine Products and Industrial Products. Segment selection was based on the internal organizational structure, management of operations, and performance evaluation by management and the Company’s Board of Directors. 2012 10-K data (in thousands of US dollars) for the segments appear in the table below.

The Engine Products segment sells to original equipment manufacturers (OEMs)

in the construction, mining, agriculture, aerospace, defense, and truck markets and to independent distributors, OEM dealer networks, private label accounts, and large equipment fleets. Products include air filtration systems, exhaust and emission systems, liquid filtration systems including hydraulics, fuel, and lube, and replacement filters.

The Industrial Products segment sells to various industrial end-users, OEMs of gas-fired turbines, and OEMs and end-users requiring clean air. Products include dust, fume, and mist collectors, compressed air purification systems, air filtration systems for gas turbines, membrane-based products, and specialized air and gas filtration systems for applications including computer hard disk drives and other electronic equipment.

i. Why might an analyst use a sum-of-the-parts approach to value Donaldson’s?

ii. How might an analyst use the provided information in an analysis and valuation?

Step by Step Answer: