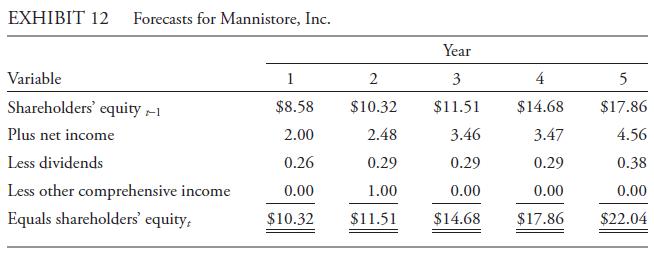

Exhibit 12 gives per-share forecasts for Mannistore, Inc., a hypothetical company operating a chain of retail stores.

Question:

Exhibit 12 gives per-share forecasts for Mannistore, Inc., a hypothetical company operating a chain of retail stores. The company’s cost of capital is 10 percent.

i. A ssuming the forecasted terminal price of Mannistore’s shares at the end of year 5 (time t = 5) is $68.40, estimate the value per share of Mannistore using the DDM.

ii. Given that the forecast terminal price of Mannistore’s shares at the end of year 5 (time t = 5) is $68.40, estimate the value of a share of Mannistore using the RI model and calculate residual income based on:

A. net income without adjustment, and B. net income plus other comprehensive income.

iii. Interpret your answers to Parts 2A and 2B.

iv. Assume that a forecast of the terminal price of Mannistore’s shares at the end of year 5 (time t = 5) is not available. Instead, an estimate of terminal price based on the Gordon growth model is appropriate. You estimate that the growth in net income and dividends from t = 5 to t = 6 will be 8 percent. Predict residual income for year 6, and based on that 8 percent growth estimate, determine the growth rate in forecasted residual income from t = 5 to t = 6.

Step by Step Answer: