Jill Adams is an analyst at a hedge fund that has been offered an equity stake in

Question:

Jill Adams is an analyst at a hedge fund that has been offered an equity stake in a privately held US property and liability insurer. Adams identifies Alleghany Corporation

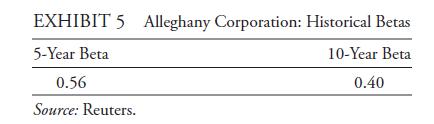

(NYSE: Y) as a publicly traded comparable company, and intends to use information about Alleghany in evaluating the offer. One sell-side analyst that Adams contacts puts Alleghany’s required return on equity at 10.0 percent. Researching the required return herself, Adams determines that Alleghany has the historical betas shown in Exhibit 5 as of late August 2007:

The estimated US equity risk premium (relative to bonds) is 4.20 percent. The YTM for:

• 91-day US Treasury bills is 0.03 percent.

• 2-year US government bonds is 3 percent.

Adams follows the most common industry practices concerning time period for estimating beta and adjustments to beta.

i. Estimate Alleghany Corporation’s adjusted beta and required return based on the CAPM.

ii. Is the sell-side analyst’s estimate of 10 percent for Alleghany’s cost of equity most consistent with Alleghany shares having above-average or below-average systematic risk?

Step by Step Answer: