Leighs comment about not considering decreases in inventory to be a source of long - term growth

Question:

A. Inconsistent with a forecasting perspective.

B. Mistaken because decreases in inventory are a use rather than a source of cash.

C. Consistent with a forecasting perspective because inventory reduction has a limit, particularly for a growing firm.

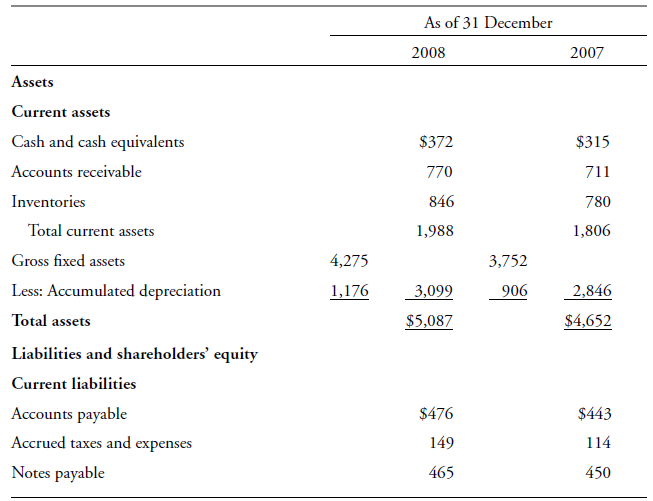

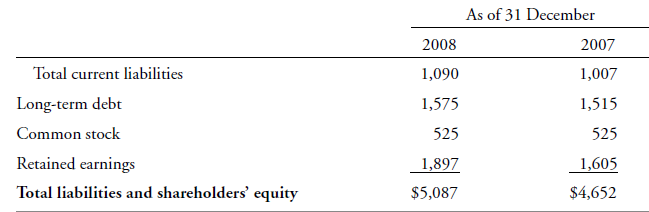

Ryan Leigh is preparing a presentation that analyzes the valuation of the common stock of two companies under consideration as additions to his firm€™s recommended list, Emerald Corporation and Holt Corporation. Leigh has prepared preliminary valuations of both companies using an FCFE model and is also preparing a value estimate for Emerald using a dividend discount model. Holt€™s 2007 and 2008 fi nancial statements, contained in Exhibits 4 - 24 and 4 - 25 , are prepared in accordance with U.S. GAAP.

EXHIBIT 4-24 Holt Corporation Consolidated Balance Sheets (US$ millions)

EXHIBIT 4-25 Holt Corporation Consolidated Income Statement for the Year Ended 31 December 2008 (US$ millions)

Total revenues ..............................................................$3,323

Cost of goods sold .........................................................1,287

Selling, general, and administrative expenses ................858

Earnings before interest, taxes, depreciation,

and amortization (EBITDA) ..........................................1,178

Depreciation expense .....................................................270

Operating income ............................................................908

Interest expense .............................................................195

Pretax income .................................................................713

Income tax (at 32 percent) ..............................................228

Net income .....................................................................$485

Leigh presents his valuations of the common stock of Emerald and Holt to his supervisor, Alice Smith. Smith has the following questions and comments:

- €œI estimate that Emerald €™ s long - term expected dividend payout rate is 20 percent and its return on equity is 10 percent over the long - term. €

- €œWhy did you use an FCFE model to value Holt€™s common stock? Can you use a DDM instead? €

- €œHow did Holt€™s FCFE for 2008 compare with its FCFF for the same year? I recommend you use an FCFF model to value Holt€™s common stock instead of using an FCFE model because Holt has had a history of leverage changes in the past. €

- €œIn the past three years, about 5 percent of Holt€™s growth in FCFE has come from decreases in inventory. €

Leigh responds to each of Smith€™s points as follows:

- €œ I will use your estimates and calculate Emerald€™s long - term, sustainable dividend growth rate. €

- €œ There are two reasons why I used the FCFE model to value Holt€™s common stock instead of using a DDM. The first reason is that Holt€™s dividends have differed significantly from its capacity to pay dividends. The second reason is that Holt is a takeover target and once the company is taken over, the new owners will have discretion over the uses of free cash flow.€

- €œ I will calculate Holt€™s FCFF for 2008 and estimate the value of Holt€™s common stock using an FCFF model. €

- €œ Holt is a growing company. In forecasting either Holt€™s FCFE or FCFF growth rates, I will not consider decreases in inventory to be a long - term source of growth.€

When talking about the group financial statements the consolidated financial statements include Consolidated Income Statement that a parent must prepare among other sets of consolidated financial statements. Consolidated Income statement that is... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their... Free Cash Flow

Free cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the...

Step by Step Answer:

Equity Asset Valuation

ISBN: 978-0470571439

2nd Edition

Authors: Jerald E. Pinto, Elaine Henry, Thomas R. Robinson, John D. Stowe, Abby Cohen