Rosatos supervisor questions her assumption that Taiwan Semiconductor will have no premium at the end of her

Question:

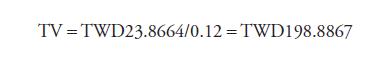

Rosato’s supervisor questions her assumption that Taiwan Semiconductor will have no premium at the end of her forecast period. Rosato assesses the effect of a terminal value based on a perpetuity of Year 2032 residual income. She computes the following terminal value:

The present value of this terminal value is as follows:

![]()

Adding TWD20.6179 to the previous value of TWD86.41 (for which the terminal value was zero) yields a total value of TWD107.03. Because the current market price of TWD95.6 is less than TWD107.03, market participants expect a continuing residual income that is lower than her new assumptions and/or are forecasting a lower interim ROE . If Rosato agrees with her supervisor and is confident in her new forecasts, she may now conclude that the company is undervalued.

Step by Step Answer: