Uwe Henschel is doing a valuation of TechnoSchaft on the basis of the following information: Year

Question:

Uwe Henschel is doing a valuation of TechnoSchaft on the basis of the following information:

• Year 0 sales per share = €25.

• Sales growth rate = 20 percent annually for three years and 6 percent annually thereafter.

• Net profit margin = 10 percent forever.

• Net investment in fixed capital (net of depreciation) = 50 percent of the sales increase.

• Annual increase in working capital = 20 percent of the sales increase.

• Debt financing = 40 percent of the net investments in capital equipment and working capital.

• TechnoSchaft beta = 1.20; the risk-free rate of return = 7 percent; the equity risk premium = 4.5 percent.

The required rate of return for equity is

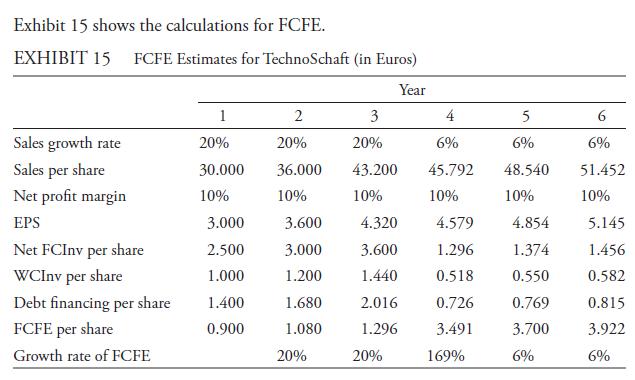

In Exhibit 15, sales are shown to grow at 20 percent annually for the first three years and then at 6 percent thereafter. Profits, which are 10 percent of sales, grow at the same rates. The net investments in fixed capital and working capital are, respectively, 50 percent of the increase in sales and 20 percent of the increase in sales. New debt financing equals 40 percent of the total increase in net fixed capital and working capital. FCFE is EPS minus the net investment in fixed capital per share minus the investment in working capital per share plus the debt financing per share.

Notice that FCFE grows by 20 percent annually for the first three years (i.e., between t = 0 and t = 3). Then, between Year 3 and Year 4, when the sales growth rate drops from 20 percent to 6 percent, FCFE increases substantially. In fact, FCFE increases by 169 percent from Year 3 to Year 4. This large increase in FCFE occurs because profits grow at 6 percent but the investments in capital equipment and working capital (and the increase in debt financing) drop substantially from the previous year. In Years 5 and 6 in Exhibit 15, sales, profit, investments, financing, and FCFE are all shown to grow at 6 percent.

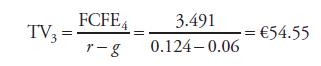

The stock value is the present value of the first three years’ FCFE plus the present value of the terminal value of the FCFE from Years 4 and later. The terminal value is

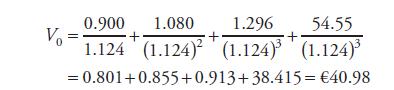

The present values are

The estimated value of this stock is €40.98 per share.

As mentioned previously, the terminal value may account for a large portion of the value of a stock. In the case of TechnoSchaft, the present value of the terminal value is €38.415 out of a total value of €40.98. The present value (PV) of the terminal value is almost 94 percent of the total value of TechnoSchaft stock.

Step by Step Answer: