Welch Corporation uses bond, preferred stock, and common stock financing. The market value of each of these

Question:

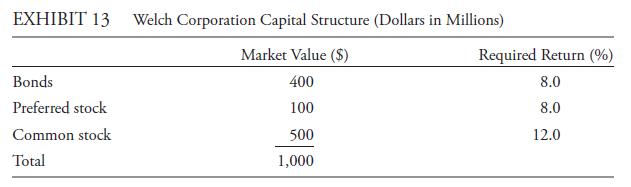

Welch Corporation uses bond, preferred stock, and common stock financing. The market value of each of these sources of financing and the before-tax required rates of return for each are given in Exhibit 13:

Other financial information (dollars in millions):

• Net income available to common shareholders = $110.

• Interest expenses = $32.

• Preferred dividends = $8.

• Depreciation = $40.

• Investment in fixed capital = $70.

• Investment in working capital = $20.

• Net borrowing = $25.

• Tax rate = 30 percent.

• Stable growth rate of FCFF = 4.0 percent.

• Stable growth rate of FCFE = 5.4 percent.

i. Calculate Welch Corporation’s WA CC.

ii. Calculate the current value of FCFF.

iii. Based on forecasted Year 1 FCFF, what is the total value of Welch Corporation and the value of its equity?

iv. Calculate the current value of FCFE.

v. Based on forecasted Year 1 FCFE, what is the value of equity?

Step by Step Answer: