The asset turnover ratio (ATR) is the ratio of a company?s revenues to the value of its

Question:

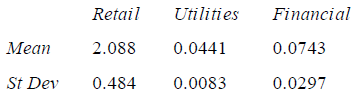

The asset turnover ratio (ATR) is the ratio of a company?s revenues to the value of its assets (indicating its efficiency in deploying its assets). We should not use the standard deviation to compare ATR variation among industrial sectors because firms with large asset bases (e.g., utilities, financial) typically have lower mean ATR than, say, retail firms.

(a) Use the sample data to calculate the coefficient of variation for each sector.

(b) Which sector has the highest degree of relative variation? The lowest?

(c) If someone (incorrectly) used the standard deviations to compare variation, would the ranking among sectors be the same?

Asset turnover is sales divided by total assets. Important for comparison over time and to other companies of the same industry. This is a standard business ratio.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Essential Statistics In Business And Economics

ISBN: 9781260239508

3rd Edition

Authors: David Doane, Lori Seward

Question Posted: