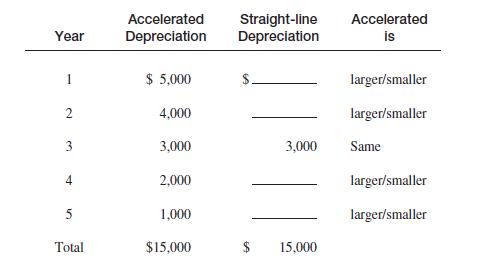

There are many ways of calculating accelerated depreciation amounts. The following table shows one of them. The

Question:

There are many ways of calculating accelerated depreciation amounts. The following table shows one of them. The asset has a depreciable cost of $15,000 and a service life of five years. Enter the amounts for straight-line depreciation and show whether accelerated depreciation is larger or smaller in each of the 5 years.

Accelerated depreciation is used principally in calculating taxable income.

Taxable income and accounting income are not always the same, and hence the income tax paid and the income tax expense may be different.

The difference becomes a liability account on the balance sheet called Deferred Income Taxes . This concept is beyond the scope of the introductory material in this text.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: