A stock has had the following year-end prices and dividends: What are the arithmetic and geometric returns

Question:

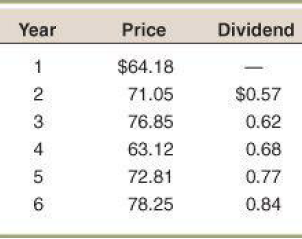

A stock has had the following year-end prices and dividends:

What are the arithmetic and geometric returns for the stock?

Transcribed Image Text:

Price Year Dividend $64.18 $0.57 71.05 76.85 0.62 4 63.12 0.68 72.81 0.77 78.25 0.84

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 54% (11 reviews)

To calculate the arithmetic and geometric average returns we must first calculate the return for each year The return for each year is R 1 7105 6418 057 6418 1159 or 1159 R 2 7685 7105 062 7105 0904 or 904 R 3 6312 7685 068 7685 1698 or 1698 R 4 7281 6312 077 6312 1657 or 1657 R 5 7825 7281 084 7281 0863 or 0863 The arithmetic average return ...View the full answer

Answered By

Morgan Njeri

Very Versatile especially in expressing Ideas in writings.

Passionate on my technical knowledge delivery.

Able to multitask and able to perform under pressure by handling multiple challenges that require time sensitive solution.

Writting articles and video editing.

Revise written materials to meet personal standards and satisfy clients demand.

Help Online Students with their course work.

4.90+

12+ Reviews

38+ Question Solved

Related Book For

Essentials Of Corporate Finance

ISBN: 9780073382463

7th Edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

Question Posted:

Students also viewed these Business questions

-

You bought one of Rocky Mountain Manufacturing Co.s 8 percent coupon bonds one year ago for $1,045.30. These bonds make annual payments and mature nine years from now. Suppose you decide to sell your...

-

You have $10,000 to invest in a stock portfolio. Your choices are Stock X with an expected return of 13 percent and Stock Y with an expected return of 10 percent. If your goal is to create a...

-

You own a stock portfolio invested 25 percent in Stock Q, 20 percent in Stock R, 45 percent in Stock S, and 10 percent in Stock T. The betas for these four stocks are .85, .91, 1.31, and 1.76,...

-

Explain why entrepreneurial firms are often in a strong position to use combination strategies.

-

Analyze the periodic boundary value problem for the angular displacement of a circular ring along the same lines as the free case done in Example 11.3. Let 0 x 2n denote the angular coordinate...

-

Use truth tables to prove the validity or invalidity of each of the argument forms in Section 8.5, Group B, pp. 2889. (P 1 ): (I J) (I J) (P2):~ (I J) ~(I J )

-

How do you balance the need to involve clients with the equally important need to freeze project scope in order to complete the project in a timely fashion? Dotcom.com, a software engineering and...

-

Dirkson Company and Hawkins Corporation, two corporations of roughly the same size, are both involved in the manufacture of in-line skates. Each company depreciates its plant assets using the...

-

Prepare a classified balance sheet in good form. (No monetary amounts are to be shown.) P5-2 (L03) EXCEL (Balance Sheet Preparation) Presented below are a number of balance sheet items for Montoya,...

-

Toner Corporation computed the following taxable income and loss: 2020 taxable income, $10,000 and 2021 tax- able loss, $40,000. At the end of 2021, Toner made the following estimates: 2022 taxable...

-

A stock has had returns of 18 percent, 28 percent, 12 percent, 9 percent, 34 percent, and 26 percent over the last six years. What are the arithmetic and geometric returns for the stock?

-

1. What advantages/disadvantages do the mutual funds offer compared to company stock for your retirement investing? 2. Notice that, for every dollar you invest, S&S Air also invests a dollar. What...

-

On January 1, 2020, Animation Ltd., which uses ASPE, sold a truck to Letourneau Finance Corp. for $65,000 and immediately leased it back. The truck was carried on Animations books at $53,000, net of...

-

Discuss difference between nominal interest rate and real interest rate. Explain why real interest rate is more important than the nominal interest rate using your answer to Question 1 of the...

-

Refer to Figure 14-1. How would an increase in the money supply move the economy in the short and long run?

-

1) Special Relativity. Statement: Imagine this situation: Alice stands in New York City while Bob, aboard a plane departing from Boston, directly crosses over Alice at t=0. Disregard the vertical...

-

According to the College Board website, the scores on the math part of the SAT (SAT-M) in a certain year had a mean of 507 and a standard deviation of 111. Assume that SAT scores follow a normal...

-

Pay and incentive programs are being used both for knowledge workers and in non-knowledge worker occupations. In every industry, from restaurants to construction and low-tech manufacturing, companies...

-

A machinist must produce a bearing that is within 0.01 inches of the correct diameter of 5.0 inches. Using x as the diameter of the bearing, write this statement using absolute value notation.

-

Troy is a qualified radiologist who operates a successful radiology practice from purpose- built rooms attached to his house. Troy works in the practice three days a week, and the other two days he...

-

Suppose that when TMCC offered the security for $24,099, the U.S. Treasury had offered an essentially identical security. Do you think it would have had a higher or lower price? Why?

-

Suppose that when TMCC offered the security for $24,099, the U.S. Treasury had offered an essentially identical security. Do you think it would have had a higher or lower price? Why?

-

Suppose that when TMCC offered the security for $24,099, the U.S. Treasury had offered an essentially identical security. Do you think it would have had a higher or lower price? Why?

-

business law A partner may actively compete with the partnership True False

-

A company provided the following data: Selling price per unit $80 Variable cost per unit $45 Total fixed costs $490,000 How many units must be sold to earn a profit of $122,500?

-

Suppose a 10-year, 10%, semiannual coupon bond with a par value of $1,000 is currently selling for $1,365.20, producing a nominal yield to maturity of 7.5%. However, it can be called after 4 years...

Study smarter with the SolutionInn App