According to the 2018 Value Line Investment Survey, the growth rate in dividends for Ralph Lauren for

Question:

According to the 2018 Value Line Investment Survey, the growth rate in dividends for Ralph Lauren for the next five years will be .5 percent. If investors feel this growth rate will continue, what is the required return for the company?s stock?

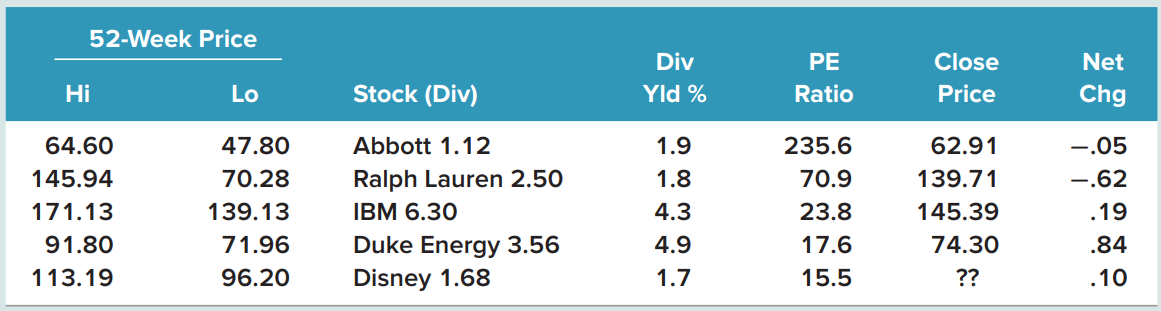

You?ve collected the following information from your favorite financial website.

Transcribed Image Text:

52-Week Price Div PE Close Net Stock (Div) Hi Chg Lo Yld % Ratio Price 64.60 Abbott 1.12 235.6 47.80 1.9 62.91 -.05 -.62 145.94 70.28 Ralph Lauren 2.50 1.8 70.9 139.71 139.13 IBM 6.30 171.13 4.3 23.8 145.39 .19 Duke Energy 3.56 17.6 91.80 71.96 4.9 74.30 .84 Disney 1.68 113.19 96.20 1.7 15.5 ?? .10

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 62% (8 reviews)

We need to find the required return of the stock Using the constant gro...View the full answer

Answered By

MICHAEL KICHE

I was employed studypool for the first time in tutoring. I did well since most of my students and clients got the necessary information and knowledge requested for. I always submitted the answers in time and followed the correct formatting in answering eg MLA or APA format,

Again I worked with the writers bay where I did writing and got many clients whom we worked with so closely. They enjoyed every single service I delivered to them. My answers are always correct.

4.70+

13+ Reviews

54+ Question Solved

Related Book For

Essentials of Corporate Finance

ISBN: 978-1260013955

10th edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

Question Posted:

Students also viewed these Business questions

-

Youve collected the following information from your favorite financial Web site. 1. Find the quote for the Laclede Group. Assume that the dividend is constant. 2. What was the highest dividend yield...

-

What is the required return on the market, on a stock with a beta of 1.0, and on a stock with a beta of 1.7? Assume that the risk-free rate is 5% and that the market risk premium is 7%.

-

What is the required return on an investment with a beta of 1.3 if the riskfree rate is 2.0 percent and the return on the market is 8.1 percent? If the expected return on the investment is 11.2...

-

Presented below is information related to Larkspur Inc.'s inventory, assuming Larkspur uses lower-of-LIFO cost-or-market. (per unit) Skis Boots Parkas Historical cost $224.20 $125.08 $62.54 Selling...

-

For the following events, specify whether they occur during mitosis, meiosis I, or meiosis II: A. Separation of conjoined chromatids within a pair of sister chromatids B. Pairing of homologous...

-

Generally accepted accounting principles are: a. a set of standards and rules that are recognized as a general guide for financial reporting. b. usually established by the Internal Revenue Service....

-

Demonstrate that, in the case where the x(K) 0 linearly with strike, the implied volatility must necessarily rise asymptotically to infinity. On this basis, explain why any implied volatility...

-

A 360-lb motor is bolted to a light horizontal beam. The unbalance of its rotor is equivalent to a 0.9-oz weight located 7.5 in. from the axis of rotation, and the static deflection of the beam due...

-

E 1 9 . 1 ( LO 1 , 2 ) Excel ( Pension Expense, Journal Entries ) The following information is availablefor the pension plan of Radcliffe Company for the year 2 0 2 5 . Actual and expected return on...

-

White Tiger Electronics produces CD players using an automated assembly line process. The standard cost of CD players is $150 per unit (labor, $30; materials, $70; and overhead, $50). The sales price...

-

According to the 2018 Value Line Investment Survey, the growth rate in dividends for IBM for the next five years is expected to be 5 percent. Suppose IBM meets this growth rate in dividends for the...

-

According to the 2018 Value Line Investment Survey, the growth rate in dividends for Abbott Laboratories for the previous five years has been negative 11.5 percent. If investors feel this growth rate...

-

Calculate the mole fraction of solute in the following aqueous solutions: (a) 21.7% CH 3 CH 2 OH, by mass; (b) 0.684 mol kg -1 CO(NH 2 ) 2 (urea).

-

A certain random process \(U(t)\) takes on equally probable values +1 or 0 with changes occurring randomly in time. The probability that \(n\) changes occur in time \(\tau\) is known to be \[...

-

The focal points of the two converging lenses shown in Figure P33.121 are denoted by solid dots for the left lens and open dots for the right lens. Draw a simplified ray diagram to locate the final...

-

Suppose that country A has 9,000 worker hours available for production and that it initially has the technology given by case 3 of Exercise 1. Derive its PPF and determine its exact dimensions. data...

-

The table shows experimental values of the variables x and y. The variables are known to be related by the equation y = a e nx where a and n are constants. a. Draw the graph of ln y against x. b....

-

Construct the Nyquist diagram for a single-degree-of-freedom system with hysteretic damping.

-

a. Which of the following formulae represent alkanes, which represent alkenes and which represent neither? CH 3 , C 6 H 12 , C 5 H 12 , C 6 H 6 , C 9 H 20 , C 12 H 24 , C 20 H 42 , C 2 H 4 , C 8 H 18...

-

What do you think?

-

Mullineaux Corporation has a target capital structure of 60 percent common stock, 5 percent preferred stock, and 35 percent debt. Its cost of equity is 12 percent, the cost of preferred stock is 5...

-

Sixx AM Manufacturing has a target debtequity ratio of .45. Its cost of equity is 13 percent, and its cost of debt is 6 percent. If the tax rate is 35 percent, what is the companys WACC?

-

Erna Corp. has 8 million shares of common stock outstanding. The current share price is $73, and the book value per share is $7. Erna Corp. also has two bond issues outstanding. The first bond issue...

-

Estimate the intrinsic value of the stock company ABC. Dividends were just paid at $8 per share and are expected to grow by 5%. You require 20% on this stock given its volatile characteristics. If...

-

Crane, Inc., a resort management company, is refurbishing one of its hotels at a cost of $6,794,207. Management expects that this will lead to additional cash flows of $1,560,000 for the next six...

-

Match each of the following transactions with the applicable internal control principle that is being violated

Study smarter with the SolutionInn App