Asset W has an expected return of 11.6 percent and a beta of 1.23. If the risk-free

Question:

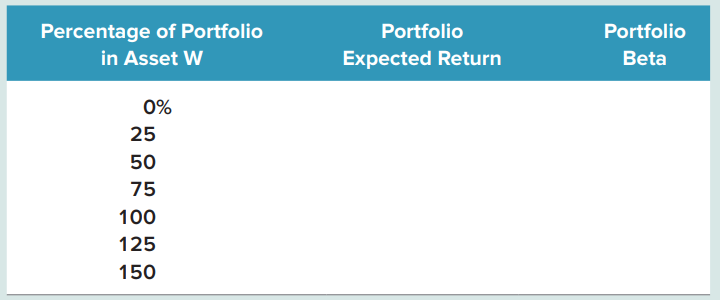

Asset W has an expected return of 11.6 percent and a beta of 1.23. If the risk-free rate is 3.15 percent, complete the following table for portfolios of Asset W and a risk-free asset. Illustrate the relationship between portfolio expected return and portfolio beta by plotting the expected returns against the betas. What is the slope of the line that results? Asset W has an expected return of 11.6 percent and a beta of 1.23. If the risk-free rate is 3.15 percent, complete the following table for portfolios of Asset W and a risk-free asset. Illustrate the relationship between portfolio expected return and portfolio beta by plotting the expected returns against the betas. What is the slope of the line that results?

Step by Step Answer:

Essentials of Corporate Finance

ISBN: 978-1260013955

10th edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan