Bausch Company is presented with the following two mutually exclusive projects. The required return for both projects

Question:

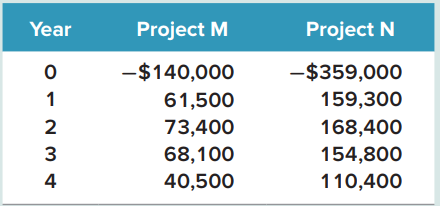

Bausch Company is presented with the following two mutually exclusive projects. The required return for both projects is 15 percent.

a. What is the IRR for each project?b. What is the NPV for each project?c. Which, if either, of the projects should the company accept?

Transcribed Image Text:

Year Project M Project N -$359,000 -$140,000 159,300 61,500 73,400 68,100 2 168,400 3 154,800 110,400 40,500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 92% (13 reviews)

a The IRR for each project is M 140000 615001 IRR 734001 IRR 2 681001 IRR 3 405001 IRR 4 Using a ...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

Essentials of Corporate Finance

ISBN: 978-1260013955

10th edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

Question Posted:

Students also viewed these Business questions

-

Kerron Company is presented with the following two mutually exclusive projects. The required return for both projects is 15 percent. Year _________Project M ___________Project N 0 .....................

-

Bee Ware company is presented with the following two mutually exclusive projects. The required return for both projects is 15 percent. (a) What is the IRR for each project? (b) What is the NPV for...

-

NPV and IRR. Higher Ground Company is presented with the following two mutually exclusive projects. The required return for both projects is 15 percent. a. What is the IRR for each project? b. What...

-

Which of the following statements is true for real gases? Choose all that apply. 1. As attractive forces between molecules increase, deviations from ideal behavior become more apparent at relatively...

-

Jessica Company buys and resells a perishable product. A large purchase at the beginning of each month provides a lower per unit cost and assures that Jessica can purchase all the items it wishes....

-

Queuing theory deals with the trade-off between the cost of providing good service and the hard to quantify cost of customer waiting time. a. True b. False

-

interpret the tables, diagrams and statistics that you use correctly. LO9

-

On April 15, 2015, Sampson Consulting provides services to a customer for $ 110,000. To pay for the services, the customer signs a three- year, 12% note. The face amount is due at the end of the...

-

QUESTION 1 Value stream costing eliminates most of the transactions associated with conventional cost accounting because it ... A. makes more extensive use of standard costing. B. gathers and reports...

-

The bar graph in Fig. 6 gives the intended majors of a group of 100 randomly selected college freshmen. (The biology category includes the biological and life sciences.) Six more students intend to...

-

Coore Manufacturing has the following two possible projects. The required return is 12 percent. a. What is the profitability index for each project?b. What is the NPV for each project?c. Which, if...

-

Consider the following two mutually exclusive projects: Whichever project you choose, if any, you require a return of 13 percent on your investment. a. If you apply the payback criterion, which...

-

How would you suggest modifying the process to accommodate 120 applications per hour? What is the cost per application of this new configuration? lop52

-

Some people jump at the chance to be a change agent while others run from the role. Why is this the case? What are some characteristics of successful change agentry? These factors should refer to the...

-

An S corporation with $50,000 of earnings and profits owns rental real estate and has interest income producing investments. For the last two years, 50% of its gross receipts came from passive...

-

How has Biden Lowered premiums and out of pocket costs for millions of Americans?

-

Product costs using activity rates Body-Solid Inc. manufactures elliptical exercise machines and treadmills. The products are prouced in its Fabrication and Assembly production departments. In...

-

How to start an essay on the multigenerational workforce and your experiences working with each of the generations. Begin your essay with an introduction that outlines the current generations in the...

-

The diagram shows a right-angled triangle ABC and a sector CBDC of a circle with centre C and radius 12 cm. Angle ACB = 1 radian and ACD is a straight-line. a. Show that the length of AB is...

-

Access the Federation of Tax Administrators Internet site at www. taxadmin.org/state-tax-forms and indicate the titles of the following state tax forms and publications: a. Minnesota Form M-100 b....

-

The Jallouk Company has projected the following quarterly sales amounts for the coming year: a. Accounts receivable at the beginning of the year are $330. The company has a 45-day collection period....

-

Consider the following financial statement information for the Amaryliss Corporation: Assume all sales are on credit. Calculate the operating and cash cycles. How do you interpret your answer? Item...

-

Brunell Products has projected the following sales for the coming year: Sales in the year following this one are projected to be 15 percent greater in each quarter. a. Calculate payments to suppliers...

-

Bought an old van for 4000 from Peters promising to pay laterwhat is the transactions

-

Company has a following trade credit policy 1/10 N45. If you can borrow from a bank at 9,5% annual rate, would it be beneficial to borrow money and pay off invoices earlier?

-

Given the following exchange rates, which of the multiple-choice choices represents a potentially profitable inter-market arbitrage opportunity? 129.87/$1.1226/$0.00864/ 114.96/ B $0.8908/ (C)...

Study smarter with the SolutionInn App