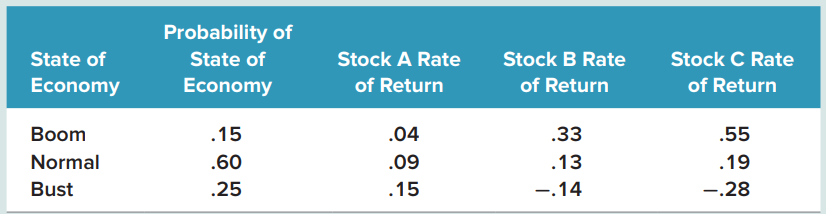

Consider the following information on a portfolio of three stocks: a. If your portfolio is invested 40

Question:

Consider the following information on a portfolio of three stocks:

a. If your portfolio is invested 40 percent each in A and B and 20 percent in C, what is the portfolio?s expected return? The variance? The standard deviation?b. If the expected T-bill rate is 3.75 percent, what is the expected riskpremium on the portfolio?

PortfolioA portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Essentials of Corporate Finance

ISBN: 978-1260013955

10th edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

Question Posted: