Consider two mutually exclusive new product launch projects that Nagano Golf is considering. Assume the discount rate

Question:

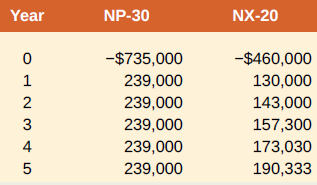

Consider two mutually exclusive new product launch projects that Nagano Golf is considering. Assume the discount rate for both products is 15 percent.

Project ? ?Nagano NP-30.

A: ? ?Professional clubs that will take an initial investment of $735,000 at Year 0.

For each of the next 5 years (Years 1?5), sales will generate a consistent cash flow of $239,000 per year.

Introduction of new product at Year 6 will terminate further cash flows from this project.

Project ? ?Nagano NX-20.

B: ? ?High-end amateur clubs that will take an initial investment of $460,000 at Year 0.

Cash flow at Year 1 is $130,000. In each subsequent year, cash flow will grow at 10 percent per year.

Introduction of new product at Year 6 will terminate further cash flows from this project.

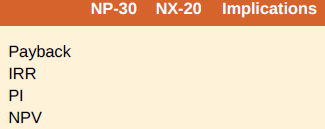

Please fill in the following table:

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal...

Step by Step Answer:

Corporate Finance

ISBN: 978-1259918940

12th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan