Howell Petroleum, Inc., is trying to evaluate a generation project with the following cash flows: a. If

Question:

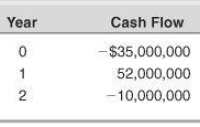

Howell Petroleum, Inc., is trying to evaluate a generation project with the following cash flows: a. If the company requires a 10 percent return on its investments, should it accept this project? Why?

a. If the company requires a 10 percent return on its investments, should it accept this project? Why?

b. Compute the IRR for this project. How many IRRs are there? If you apply the IRR decision rule, should you accept the project or not? What’s going on here?

Transcribed Image Text:

Cash Flow Year -$35,000,000 52,000,000 -10,000,000 2.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 90% (10 reviews)

a The equation for the NPV of the project is NPV 35000000 52000000110 10000000110 ...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Essentials Of Corporate Finance

ISBN: 9780073382463

7th Edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

Question Posted:

Students also viewed these Business questions

-

What is the profitability index for the following set of cash flows if the relevant discount rate is 10 percent? What if the discount rate is 15 percent? If it is 22 percent? Cash Flow Year -$28,000...

-

Inc., has the following two mutually exclusive projects available. What is the crossover rate for these two projects? What is the NPV of each project at the crossover rate? Project R Year Project S...

-

Rework Problem 55 assuming that the loan agreement calls for a principal reduction of $20,000 every year instead of equal annual payments. Data From Problem 55 Prepare an amortization schedule for a...

-

Campione Manufacturing acquired an 80% interest in DaLuca Distributors, a foreign corporation established on November 1, 2006, for 650,000 foreign currency units (FC). Campione acquired its 80%...

-

Suppose Noble's production function (see Problem 7) is as follows: Q = 7V - 0.5V2 where Q is the number of widgets produced per day and Vis the number of production workers working an 8-hour day. a....

-

Design a sum-of-products circuit for segment 2 of the full seven-segment decoder described in Exercise 6.14. Data in Exercise 6.14. This and following exercises (6.14 6.41) share the description of...

-

Properties of cemented soils. The Bulletin of Engineering Geology and the Environment (Vol. 69, 2010) published a study of cemented sandy soils. The researchers applied one of three different...

-

Yan Yan Corp. has a $2,000 par value bond outstanding with a coupon rate of 4.9 percent paid semiannually and 13 years to maturity. The yield to maturity of the bond is 3.8 percent. What is the price...

-

Explain how legal capital protects a corporation's creditors and discuss two different ways that legal capital can be established by a corporation

-

The Jurassic Classics has four employees on its sales team and uses a compensation that provides each person with a base salary of $40,000 per year and the opportunity to earn commission on sales....

-

Consider the following two mutually exclusive projects: Sketch the NPV profiles for X and Y over a range of discount rates from zero to 25 percent. What is the crossover rate for these two projects?...

-

J. Marcel Enterprises has gathered projected cash flows for two projects. At what interest rate would the company be indifferent between the two projects? Which project is better if the required...

-

Some people modify cars to be much closer to the ground than when manufactured. Should they install stiffer springs? Explain your answer.

-

Choose any global organization that successfully undertook a strategic transformation to adapt to changing market dynamics and sustain its competitive advantage. Examine the company's challenges,...

-

In examining C&C Sports through the lens of a SWOT analysis, several key factors come to light. The strengths of the company are evident in its established brand reputation and a loyal customer base...

-

A perfectly insulated container initially contains 0.2 kg of ice at -15 C. Now we add water at 30 C, but only the minimum amount needed to barely melt all the ice. Find the net entropy change of the...

-

Analysts and investors often use return on equity ( ROE ) to compare profitability of a company with other firms in the industry. ROE is considered a very important measure, and managers strive to...

-

Provide a brief summary of the case. Respond to the following: 1. Discuss the factors which contributed to the success of the change process in terms of unfreeze, move, and refreeze stages in force...

-

For the following exercises, find the slope of the line that passes through the two given points. (1, 4) and (5, 2)

-

Prove that the mean heat capacities C P H and C P S are inherently positive, whether T > T 0 or T < T 0 . Explain why they are well defined for T = T 0 .

-

The Anberlin Co. had $255,000 in 2011 taxable income. Using the rates from Table 2.3 in the chapter, calculate the companys 2011 incometaxes. TABLE 2.3 Taxable Income Tax Rate Corporate Tax Rates 0-...

-

Chevelle, Inc., has sales of $39,500, costs of $18,400, depreciation expense of $1,900, and interest expense of $1,400. If the tax rate is 35 percent, what is the operating cash flow, or OCF?

-

Earnhardt Driving Schools 2010 balance sheet showed net fixed assets of $2.8 million, and the 2011 balance sheet showed net fixed assets of $3.6 million. The companys 2011 income statement showed a...

-

DETAILS 1. [-/1 Points) SMITHNM13 11.2.025. MY NOTES Convert the credit card rate to the APR. Oregon, 2% per month % Need Help? ReadIt Watch

-

Corom Stack Standard CALCULATOR PRINTER VERSION BACK NEXT Problem 13-02A a-c (Part Level Submission) Sheffield Corporation had the following stockholders' equity accounts on January 1, 2020: Common...

-

Suppose that you own 2,100 shares of Nocash Corp. and the company is about to pay a 25% stock dividend. The stock currently sells at $115 per share. a. What will be the number of shares that you hold...

Study smarter with the SolutionInn App