Kopperud Electronics has an investment opportunity to produce a new HDTV. The required investment on January 1

Question:

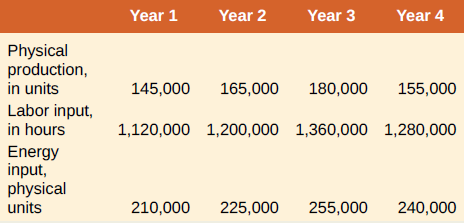

Kopperud Electronics has an investment opportunity to produce a new HDTV. The required investment on January 1 of this year is $115 million. The firm will depreciate the investment to zero using the straight-line method over four years. The investment has no resale value after completion of the project. The firm is in the 21 percent tax bracket. The price of the product will be $415 per unit, in real terms, and will not change over the life of the project. Labor costs for Year 1 will be $15.70 per hour, in real terms, and will increase at 2 percent per year in real terms.Energy costs for Year 1 will be $4.10 per physical unit, in real terms, and will increase at 3 percent per year in real terms. The inflation rate is 5 percent per year. Revenues are received and costs are paid at year-end. Refer to the following table for the production schedule:

The real discount rate for the project is 4 percent. Calculate the NPV of this project.

Discount RateDepending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal...

Step by Step Answer:

Corporate Finance

ISBN: 978-1259918940

12th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan