Locate the Treasury issue in Figure 6.3 maturing in February 2029. What is its coupon rate? What

Question:

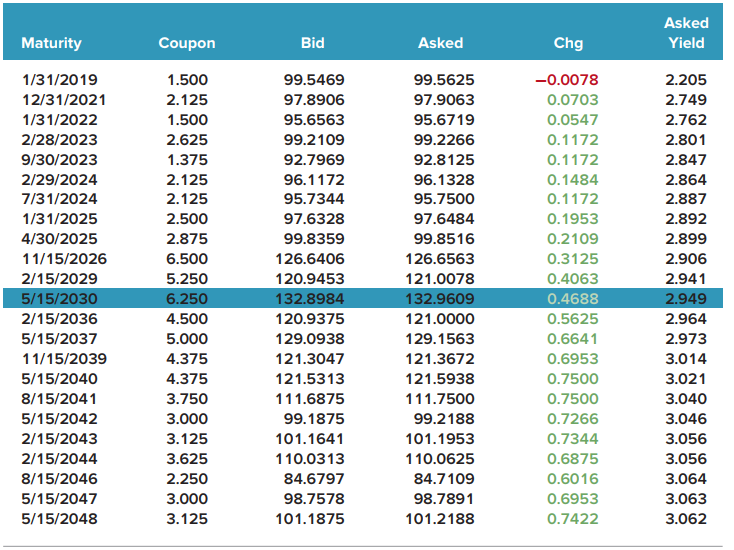

Locate the Treasury issue in Figure 6.3 maturing in February 2029. What is its coupon rate? What is the dollar bid price for a $1,000 par value bond? What was the previous day?s asked price for a $1,000 par value bond?

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Transcribed Image Text:

Asked Maturity Coupon Bid Asked Chg Yield 1/31/2019 1.500 99.5469 99.5625 -0.0078 2.205 12/31/2021 97.9063 2.125 97.8906 0.0703 2.749 1.500 1/31/2022 95.6563 95.6719 0.0547 2.762 2/28/2023 2.625 99.2109 99.2266 0.1172 2.801 9/30/2023 1.375 92.7969 92.8125 0.1172 2.847 2/29/2024 2.125 96.1172 96.1328 0.1484 2.864 7/31/2024 2.125 95.7344 95.7500 0.1172 2.887 2.500 1/31/2025 97.6328 97.6484 0.1953 2.892 4/30/2025 2.875 99.8359 99.8516 0.2109 2.899 11/15/2026 6.500 126.6406 126.6563 0.3125 2.906 2/15/2029 5.250 120.9453 121.0078 0.4063 2.941 5/15/2030 6.250 132.8984 132.9609 0.4688 2.949 2/15/2036 4.500 120.9375 121.0000 0.5625 2.964 5/15/2037 5.000 129.0938 129.1563 0.6641 2.973 11/15/2039 4.375 121.3047 121.3672 0.6953 3.014 3.021 5/15/2040 4.375 121.5313 121.5938 0.7500 8/15/2041 3.750 111.6875 111.7500 0.7500 3.040 5/15/2042 3.046 3.000 99.1875 99.2188 0.7266 2/15/2043 3.125 101.1641 101.1953 0.7344 3.056 2/15/2044 3.625 110.0313 110.0625 0.6875 3.056 8/15/2046 2.250 84.6797 84.7109 0.6016 3.064 3.063 5/15/2047 3.000 98.7578 98.7891 0.6953 3.125 101.2188 5/15/2048 101.1875 0.7422 3.062

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 45% (11 reviews)

The coupon rate located in the second column of the quote is 525 The bid price is Bid p...View the full answer

Answered By

Ann Wangechi

hey, there, paying attention to detail is one of my strong points, i do my very best combined with passion. i enjoy researching since the net is one of my favorite places to be and to learn. i am a proficient and versatile blog, article academic and research writing i possess excellent English writing skills, great proof-reading. i am a good communicator and always provide feedback in real time. i'm experienced in the writing field, competent in computing, essays, accounting and research work and also as a Database and Systems Administrator

4.90+

151+ Reviews

291+ Question Solved

Related Book For

Essentials of Corporate Finance

ISBN: 978-1260013955

10th edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

Question Posted:

Related Video

The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. This video will give a complete tutorial on how to calculate Yield to Maturity on Microsoft Excel

Students also viewed these Business questions

-

Locate the Treasury issue in Figure 6.3 maturing in August 2029. What is its coupon rate? What is the dollar bid price for a $1,000 par value bond? What was the previous day's asked price for a...

-

Locate the Treasury issue in Figure 6.3 maturing in August 2023. What is its coupon rate? What is its bid price? What was the previous day's asked price? Figure 6.3 Asked Maturity Coupon Bid Asked...

-

Locate the Treasury issue in Figure 7.4 maturing in February 2038. What is its coupon rate? What is its bid price? What was the previous day's asked price? Assume a par value of $10,000.

-

Slip Systems had no short-term investments prior to 2015. It had the following transactions involving short-term investments in available-for-sale securities during 2015. Feb. 6 Purchased 3,400...

-

Mexican hairless dogs have little hair and few teeth. When a Mexican hairless is mated to another breed of dog, about half of the puppies arc hairless. When two Mexican hairless dogs are mated to...

-

What is a capability?

-

Describe ERP software and its potential advantages to businesses. AppendixLO1

-

On April 1, 2011, CMV Corp. issued $600,000, 8%, 5-year bonds at face value. The bonds were dated April 1, 2011, and pay interest annually on April 1. Financial statements are prepared annually on...

-

Cash Budget with Supporting Cash Collections and Disbursements Schedules - Excel INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW FILE HOME Calb 11 Paste B HAA - Alignment Number Conditional Format as...

-

V.T. a 34-year-old woman, presents complaining of fatigue. difficulty concentrating, and a decline in memory She also notes unexplained weight gain over the past six months, an abnormal loss of hair,...

-

BDJ Co. wants to issue new 25-year bonds for some much-needed expansion projects. The company currently has 4.8 percent coupon bonds on the market that sell for $1,028, make semiannual payments, have...

-

Locate the Treasury bond in Figure 6.3 maturing in May 2037. Is this a premium or a discount bond? What is its current yield? What is its yield to maturity? What is the bid-ask spread for a $1,000...

-

Lance H. and Wanda B. Dean are married and live at 431 Yucca Drive, Santa Fe, NM 87501. Lance works for the convention bureau of the local Chamber of Commerce, while Wanda is employed part-time as a...

-

Refer to Figure 11.2: Is it more costly to build in Los Angeles or in Washington DC? What is the cost difference? Figure 11.2 Location Factors Costs shown in RSMeans Square Foot Costs are based on...

-

Suppose the prism in Figure P33.27 is immersed in a liquid in which the speed of light is lower than the speed of light in glass. Describe what happens to the light shown entering at normal...

-

Each year, the AICPA issues a general audit risk alert document and a number of industry audit risk alerts. If you can obtain access to a current copy of either the general alert or one of the...

-

The multieffect distillation system shown in Figure 11-4 appears to be able to cut energy use in half; however, the reduction is not this large. Explain why. Figure 11-4 F PL D, D Reflux B PH

-

Schemes 11-6E and 11-6F accomplish the same task of removing and purifying an intermediate component. a. What factors enter into the decision to use scheme \(11-6 \mathrm{~F}\) instead of \(11-6...

-

Solve each of these equations for 0 x 360. a. 3 tan 2 x sec x 1 = 0 b. 4 tan 2 x + 8 sec x = 1 c. 2 sec 2 x = 5 tan x + 5 d. 2 cot 2 x 5 cosec x 1 = 0 e. 6 cos x + 6 sec x = 13 f. cot c + 6 sin...

-

Rowland Textile Inc. manufactures two products: sweatshirts and T-shirts. The manufacturing process involves two activities: cutting and sewing. Expected overhead costs and cost drivers are as...

-

Find the EAR in each of the followingcases: Stated Rate (APR) Number of Times Compounded Effective Rate (EAR) 9% 18 14 Quarterly Monthly Daily Infinite

-

Find the APR, or stated rate, in each of the followingcases: Stated Rate (APR) Number of Times Compounded Effective Rate (EAR) Semiannually Monthly Weekly Infinite 11.5% 12.4 10.1 13.8

-

First National Bank charges 13.2 percent compounded monthly on its business loans. First United Bank charges 13.5 percent compounded semiannually. As a potential borrower, which bank would you go to...

-

The market price of a semi-annual pay bond is $979.86. It has 21.00 years to maturity and a yield to maturity of 7.34%. What is the coupon rate? Submit Answer format: Percentage Round to: 0 decimal...

-

Lakeland Inc. manufactured 2,500 units during the month of March. They incurred direct materials cost of $58,000 and overhead costs of $40,000. If their per-unit prime cost was $32.00 per unit, how...

-

Present Value Computations Using the present value tables, solve the following. ( Click here to access the PV and FV tables to use with this problem. ) Round your answers to two decimal places....

Study smarter with the SolutionInn App