The Veblen Company and the Knight Company are identical in every respect except that Veblen is unlevered.

Question:

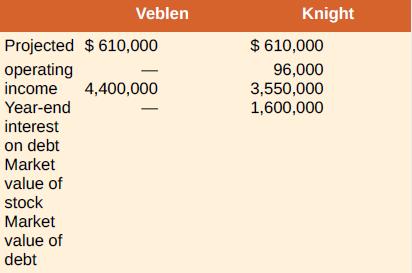

The Veblen Company and the Knight Company are identical in every respect except that Veblen is unlevered. The market value of Knight Company’s 6 percent bonds is $1.6 million. Financial information for the two firms appears here. All earnings streams are perpetuities. Neither firm pays taxes. Both firms distribute all earnings available to common stockholders immediately.

a. An investor who can borrow at 6 percent per year wishes to purchase 5 percent of Knight’s equity. Can he increase his dollar return by purchasing 5 percent of Veblen’s equity if he borrows so that the initial net costs of the two strategies are the same?

b. Given the two investment strategies in (a), which will investors choose? When will this process cease?

Step by Step Answer:

Corporate Finance

ISBN: 978-1259918940

12th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan